Free & Online Gratuity Calculator UAE 2025 (MOHRE Updated)

Gratuity Calculator UAE

Calculating your gratuity…

Your Gratuity Calculation Results

Calculation Breakdown

Working in (Dubai, Abu Dhabi or Sharjah) the UAE and unsure how to calculate your gratuity? You’re not alone — understanding end-of-service benefits can be confusing for many employees. Our UAE gratuity calculator simplifies the entire process, allowing you to estimate your final settlement accurately and within seconds. Before proceeding with the calculation, let’s take a moment to understand what gratuity actually represents under UAE Labour Law.

What is Gratuity in the UAE?

Gratuity is a statutory payment provided by an employer to an employee in recognition of their service period with the company. In the UAE, this amount is officially referred to as the end-of-service benefit and is granted upon the termination or completion of employment.

Understanding End-of-Service Benefits in the UAE

Under the UAE Labour Law, employers are legally obligated to provide gratuity payments to employees who have completed at least one year of continuous service. The final amount depends on several factors, including the employee’s type of contract, the reason for termination, and the specific provisions outlined in the labour regulations.

How does the UAE Gratuity Calculator calculate your End-of-Service Benefits?

Manually calculated gratuity can be time-consuming and there is a risk of human errors in the calculation. To overcome this issue, an online gratuity calculator tool has been developed which simplify the process. With just a single click, this calculator will instantly provide you accurate and detailed results based on the latest MOHRE rules.

Eligibility Criteria for Gratuity Calculation

Under the Article 51 of the UAE Labour Law, gratuity is a benefit granted to expatriate employees who have completed at least one year of service in the private sector. To calculate these end-of-service benefits, simply enter the employee’s basic salary, length of service, and type of contract (whether limited or unlimited) into this online calculator.

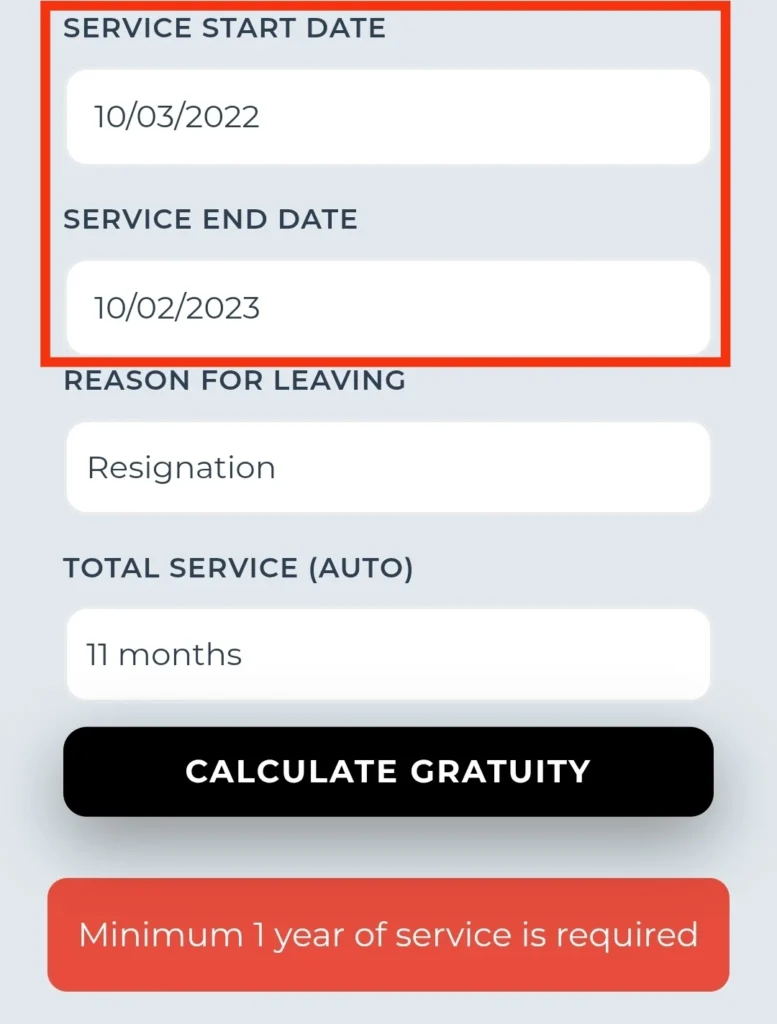

Minimum Service Duration

To be eligible for gratuity pay in the UAE, an employee must complete at least one year of continuous service. Employees who have not met this requirement are not entitled to receive end-of-service benefits, whether they work in the private or public sector.

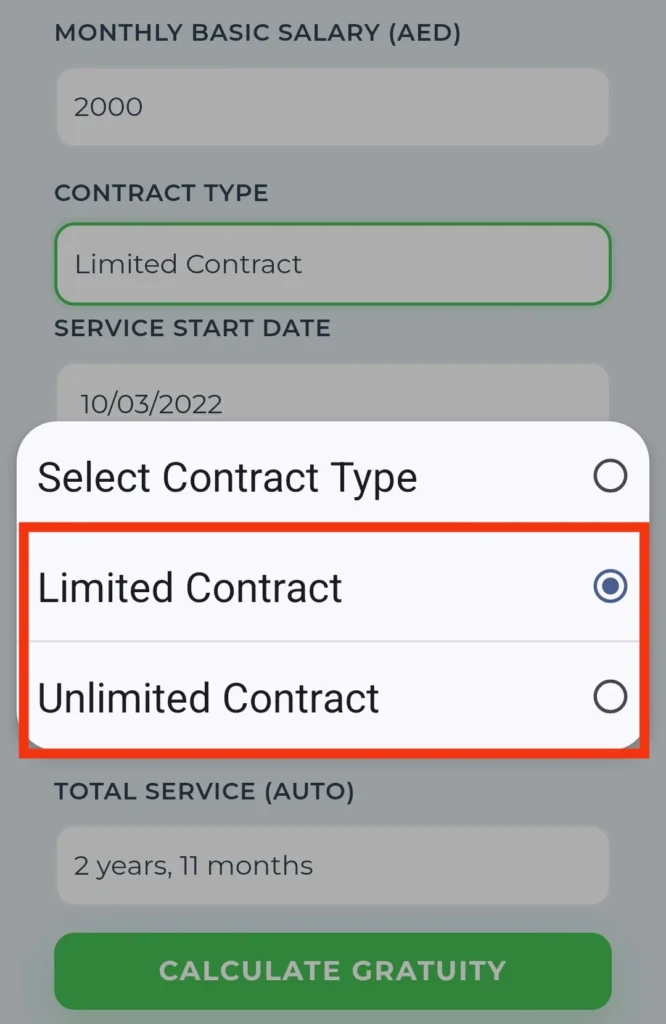

Basic Salary

While using this gratuity calculator, you need to know your monthly basic salary. As the calculation will be based on it.

What type of employment contract do you have?

There are 2 types of contracts: limited or unlimited contract. From both of these, you can choose the contract that you had with the company.

Enter your method of leaving the job

There are some methods of leaving a job. First one is that you resigned. Secondly you are terminated. Third reason your contract with the company is completed, and the last reason is that you have done a mutual agreement with the company. You need to choose one of these four options.

Select the start and end date of your employment

To estimate the duration of service. You need to select the dates from the first day you started the job to the day your job ended.

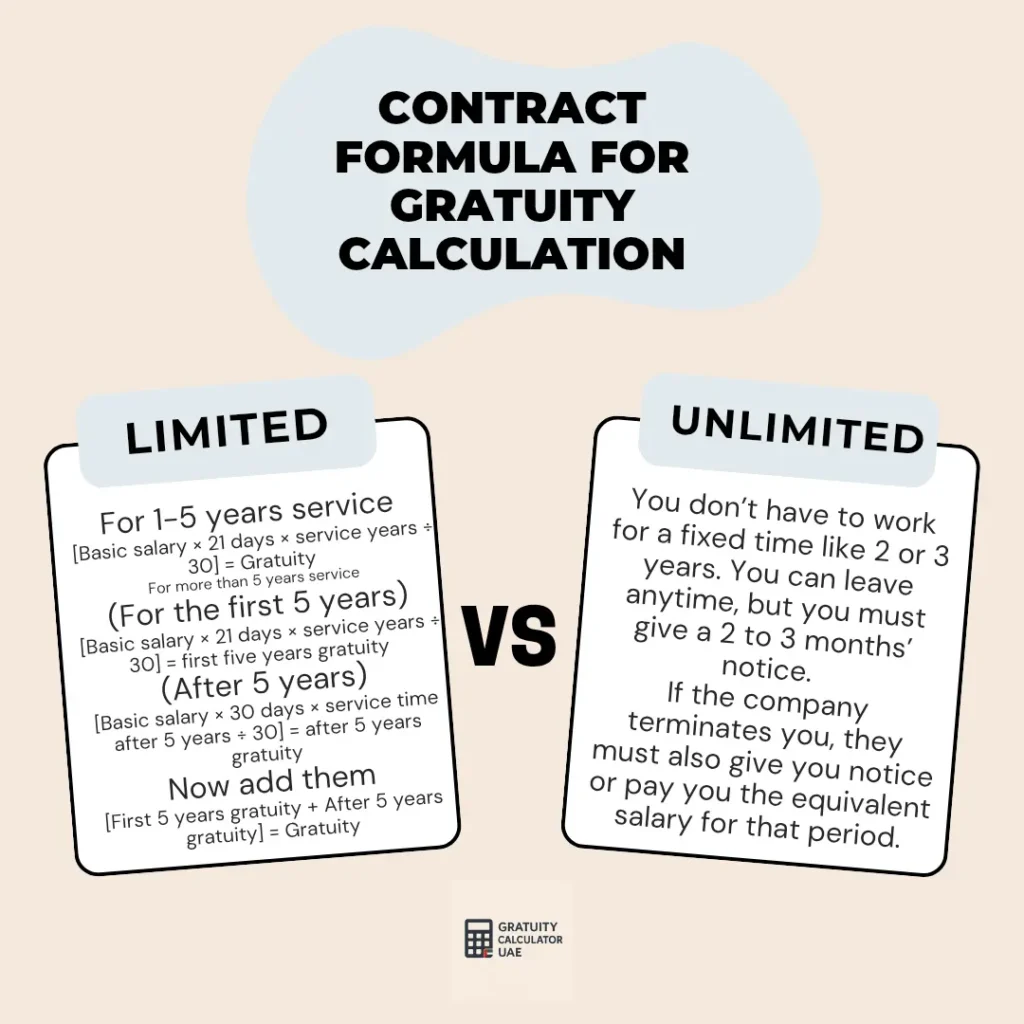

Limited contract formula for gratuity calculation

For calculating gratuity, a specific formula is used. In a limited contract, the company hires you for a fixed period of years, and you work for that company during that time. If you do not complete this period, you may lose the right to gratuity.

Formula →

- For 1–5 years service

- [Basic salary × 21 days × service years ÷ 30] = Gratuity

- For more than 5 years service

(For the first 5 years)

- [Basic salary × 21 days × service years ÷ 30] = first five years gratuity

(After 5 years)

- [Basic salary × 30 days × service time after 5 years ÷ 30] = after 5 years gratuity

Now add them

[First 5 years gratuity + After 5 years gratuity] = Gratuity

Unlimited contract formula for gratuity calculation

If you have an unlimited contract with a company, you don’t have to work for a fixed time like 2 or 3 years. You can leave anytime, but you must give a 2 to 3 months’ notice. Similarly, if the company terminates you, they must also give you notice or pay you the equivalent salary for that period. In both cases, you are entitled to receive gratuity.

Resignation

In case of resigning under an unlimited contract, the company has certain rules for end-of-service benefits.

1. If the employee resigns before completing one year, they will not receive any gratuity from the company.

2. If the employee resigns after 1 to 3 years, they will receive one-third of 21 days’ basic salary per year as gratuity.

- For example,

Basic salary = AED 2000

Gratuity per year = 2000 × 21 ÷ 30 = 1400

1/3 of 1400 = AED 467 (per year)

3. If the employee resigns after 3 to 5 years, they will receive two-thirds of 21 days’ basic salary per year as gratuity.

- For example,

Same formula → 2/3 of 1400 = AED 934 (per year)

4. If the employee resigns after 5 years, they will receive 21 days’ basic salary per year for the first five years, and 30 days’ basic salary per year for each year beyond that as gratuity.

- For example,

First 5 years: 1400 × 5 = AED 7000

Next 3 years (after 5 year) : (2000 × 30 ÷ 30) = 2000 per year × 2 = AED 4000

AED 7000 + AED 4000 = AED 11000

Total Gratuity = 11000

Termination

1. If an employee is terminated before completing 1 year, they will not be entitled to any gratuity.

2. If you are terminated after completing 1 year but before completing 5 years, you will receive 21 days’ basic salary per year as gratuity.

3. If you are terminated after 5 years, you will receive 21 days’ basic salary per year for the first 5 years, and 30 days’ basic salary per year for every year beyond that as gratuity.

Can an employer refuse to pay gratuity?

According to Article 139 of the UAE Labour Law, employees may lose their gratuity due to the following reasons.

1. If someone presents a false identity or nationality, or submits fake documents.

2. If an employee is hired by the company only for checking purposes.

3. If the employee’s mistake causes a major loss to the company and the company reports it to the office within 48 hours.

4. If an employee violates the workplace safety rules of the company during the duty—rules that are written and have been explained to the employee beforehand.

5. If an employee does not perform their duty properly and keeps repeating the same mistake despite being warned.

6. If an employee gives all the confidential information of the company to someone outside.

7. If an employee is convicted in court of a crime that shows he is not honest.

8. If an employee is found under the influence of alcohol or drugs during work.

9. If an employee fights with the employer, manager, or co-workers during work.

10. If an employee takes leave without a valid reason for more than 7 continuous days or more than 20 days in a year.

11. If an employee leaves the job on their own without giving notice, unless a valid reason is stated under Article 121.

How can you secure your gratuity?

To keep your gratuity safe, you need to understand the rules under the UAE Labour Law. You must work for at least one year without a break, and keep good service record.

After your contract with the company ends, or if you are terminated or decide to leave, ask your employer for your gratuity. If they refuse for any reason, consult a lawyer or seek help from a legal authority to claim your end-of-service benefit.

In the UAE, you can follow the steps below to claim your gratuity.

Understand your employment contract clearly

Before starting any job anywhere in the UAE, carefully read the contract made with the company. Because, every job and contract (whether limited or unlimited) has different rules and conditions.

Know your legal rights under the UAE Labour Law

If you are planning to work in a company, and you don’t know about Emirates Labour Law or the rules for receiving gratuity, then make sure to learn about them properly before starting the job. This will help you understand when you will become eligible to receive gratuity.

Keep all your employment records safe with you

Keep all important job-related documents safe, such as the date you started and ended your job. Details of the salary you received from the company, and your contract information. These documents will help you claim your gratuity when needed.

Talk to your employer about gratuity concerns

Talk to your employer about this matter and openly ask any questions you may have. This will help both of you clearly understand each other regarding gratuity during your employment. Making it easier for your employer to pay it later and for you to receive it without any issues.

Take legal support

If you face any difficulty in receiving your gratuity or have any questions related to it, you can seek help from someone in the UAE who is an expert in this field. They can assist you in successfully claiming your end-of-service benefits.