What is The New UAE Labour Law? Employment Guide 2026

Searching for a job in the UAE and want to know all the employment rules? Then no worries here we will guide you completely.

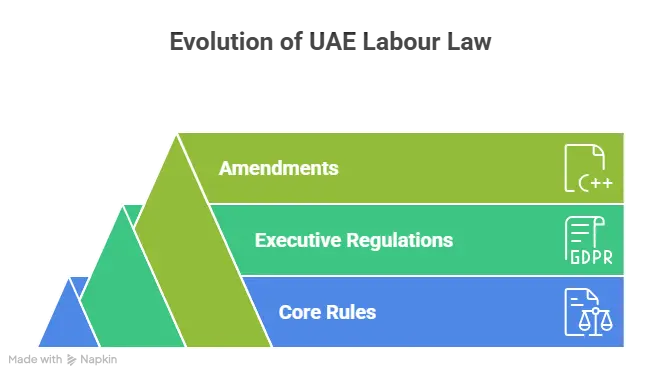

Overview of the UAE Labour Law (Federal Decree-Law No. 33 of 2021 & Amendments 2024–2025)

The UAE Labour Law is the main law for private sector jobs in the country.

Its full name is Federal Decree-Law No. 33 of 2021 Regarding the Regulation of Employment Relationship. It replaced the old labour law from 1980 and came into force on 2 February 2022.

Later, the Cabinet issued Cabinet Resolution No. 1 of 2022. This is called the Executive Regulations. It explains how many articles of the law should work in real life, such as work models, work permits, hours, leave and internal policies.

In 2024, Federal Decree-Law No. 9 of 2024 amended some parts of the law. These changes focus on labour disputes, the power of MOHRE decisions and stronger fines for violations.

You can always verify the latest official text on:

- MOHRE laws and regulations portal

- UAE Legislation Portal for Law 33 of 2021 and the Executive Regulations

Legal Layer | What it Covers |

|---|---|

Federal Decree‑Law No. 33 of 2021 | Core labour rules, contracts, leave, termination, gratuity |

Cabinet Resolution No. 1 of 2022 | Executive Regulations, work models, safety, internal policies |

Decree‑Law No. 9 of 2024 | Updated enforcement rules, dispute powers, fines |

When did the new UAE Labour Law come into force?

The new UAE Labour Law came into force on 2 February 2022 and replaced the old 1980 law for most private sector jobs.

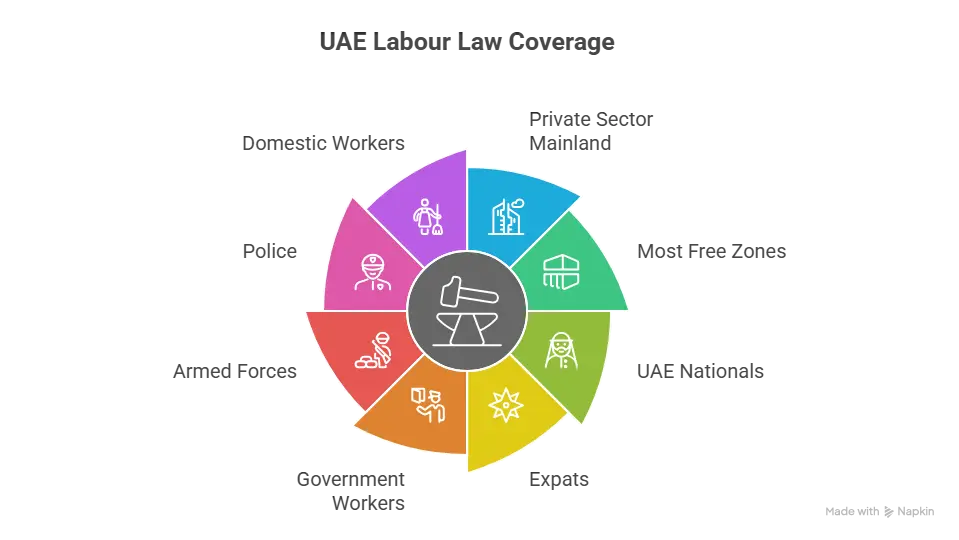

Scope of Application

The law mainly applies to:

- Private sector companies in the UAE mainland

- Most free zone companies, except some with their own labour systems

- Both UAE nationals and expatriate workers in covered sectors

It does not usually apply to:

- Federal and local government employees

- Members of the armed forces, police and security

- Domestic workers, who have a separate law (Federal Decree-Law No. 9 of 2022)

Each free zone can add extra rules, but they cannot go below the basic protections in the federal law.

Category | Coverage Status |

|---|---|

Private sector (mainland) | Covered fully |

Most free zones | Covered unless zone has its own rules |

DIFC & ADGM | Have separate frameworks |

Domestic workers | Different laws apply |

Government employees | Not covered |

Who does the UAE Labour Law apply to?

The law mainly applies to private sector companies on the UAE mainland and most free zones, and it covers both UAE nationals and expatriate workers in those sectors.

Law structure and Executive Regulations

For your understanding, the system is built in layers:

- Federal Decree-Law No. 33 of 2021

- Sets the main rules for contracts, wages, working hours, leave, termination and gratuity.

Cabinet Resolution No. 1 of 2022 (Executive Regulations)

Explains worker classifications, work models, disciplinary rules, health and safety, and internal regulations.

- Later amendments, such as Decree-Law No. 9 of 2024

- Adjust dispute rules and fines, and give MOHRE stronger enforcement powers.

When you read or apply the law, you must see both the main law and the Executive Regulations together. Courts, MOHRE and HR teams rely on this full framework.

Private sector, Free zones and Exceptions

In simple terms:

- Mainland private sector

- Law 33 of 2021 and Cabinet Resolution 1 of 2022 apply directly.

Free zones

- Many free zones follow the same federal labour law.

- Some financial free zones, like DIFC and ADGM, have their own employment regulations, so employers there follow zone-specific laws plus national rules on immigration and visas.

Domestic workers

Governed by a separate law and executive regulations, not this main labour law.

Because of these layers, employees and HR teams should always check:

- Is the company mainland or free zone

- If free zone, does it follow federal labour law or a zone law

- Which latest decree or Cabinet decision applies to their case

This article will walk through these rules in simple language, so both employees and employers can understand their rights and duties clearly.

Are domestic workers covered by the UAE Labour Law?

No, domestic workers are covered by a separate law and executive regulations, not by Federal Decree‑Law No. 33 of 2021.

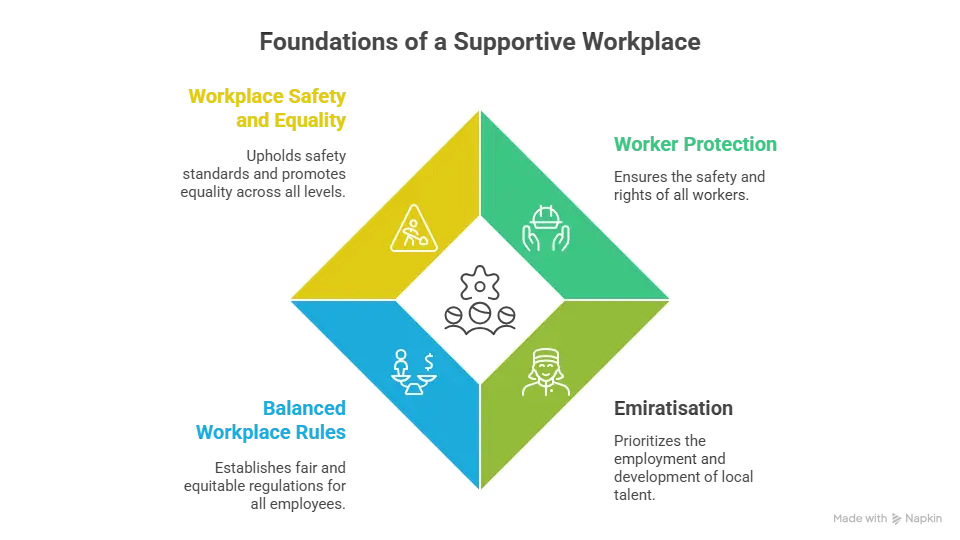

Key Legal Objectives of UAE Labour Law

The UAE Labour Law aims to create a fair and safe work environment for everyone. It supports workers, protects business interests, and strengthens the national economy. These goals are set out under Federal Decree-Law No. 33 of 2021 and later amendments by the Cabinet and the Ministry of Human Resources and Emiratisation (MOHRE).

Objective | Focus Area |

|---|---|

Worker protection | Safety, contracts, fair pay, end‑of‑service rights |

Nationalisation goals | Emirati employment, training, Nafis |

Balanced work relations | Notice periods, termination rules, dispute rights |

Safety and equality | Anti‑discrimination, equal pay, dignity, safe workplace |

Worker Protection

- The law protects workers from unfair actions and unsafe conditions.

- It sets rules for contracts, salaries, probation, termination, and end-of-service rights.

- Employers must provide clear terms of employment, fair wages, and safe working spaces.

Articles covering worker protection include:

- Article 4: Equality and non-discrimination

- Article 36: Occupational care and safety

- Article 37: Compensation for work injuries

Authorities can inspect workplaces and apply penalties if rights are violated. Workers can also file complaints through MOHRE for help and dispute resolution.

Nationalisation (Emiratisation) Goals

- The law supports Emirati participation in the private sector.

- Companies must follow nationalisation targets and register through government systems such as Nafis.

Key Points

MOHRE directives also outline penalty amounts for firms that ignore Emiratisation targets.

Balanced Employer-Employee Relationship

- The law creates balance between both sides.

- It protects worker rights but also respects business needs.

- Employers can set work policies as long as they stay within legal limits.

Examples of rules that maintain balance:

- Probation period notifications

- Fair contract termination procedures

- Clear notice periods

- Legal reasons for dismissal

- Defined rights after ending a contract

These measures help reduce disputes and improve workplace trust. MOHRE can step in if any party acts outside the law.

Workplace Safety & Equality

Safe and equal workplaces are core objectives. Employers must provide secure conditions and act against bullying or harassment.

Key legal protections

Relevant references include:

- Article 4: Equality and non-discrimination

- Article 36 and 37: Workplace safety and compensation

These rules help employees feel respected and protected. A safe environment also raises productivity and reduces legal risk for companies.

What is MOHRE in the UAE?

MOHRE is the Ministry of Human Resources and Emiratisation, the main authority that issues work permits, enforces labour rules, manages WPS, and handles labour complaints in the UAE.

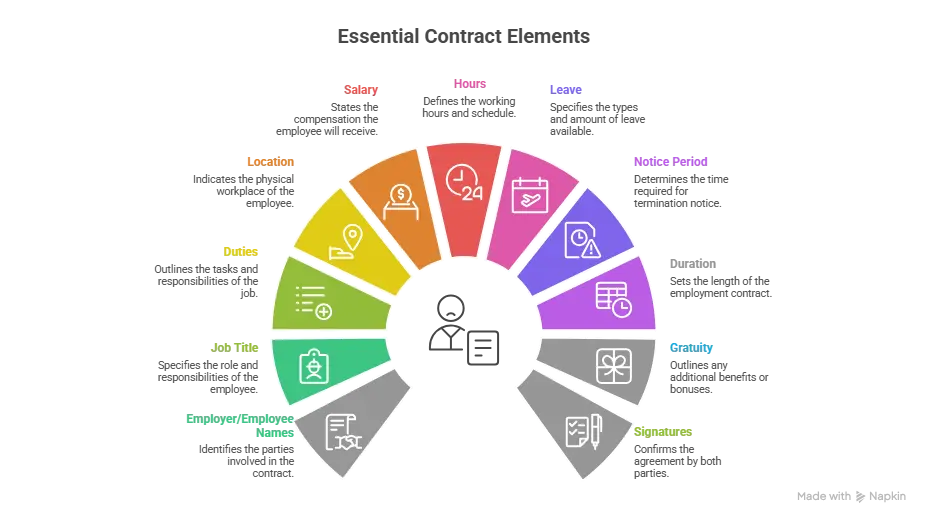

Employment Contracts Under UAE Labour Law

Employment contracts in the UAE must follow the rules set under Federal Decree-Law No. 33 of 2021 and its latest amendments. Every agreement between an employer and a worker needs to be clear, lawful, and registered with the Ministry of Human Resources and Emiratisation (MOHRE).

Mandatory Contract Requirements

Every valid employment contract should include the essential details confirmed by MOHRE. These items protect both sides and reduce disputes.

Required elements:

- Name of employer and employee

- Job title and duties

- Work location

- Salary and benefits

- Weekly work hours

- Contract duration

- Joining date

- Annual leave entitlement

- Notice period

- Gratuity eligibility

- Signature of both parties

Contracts must be issued in writing and stored on the online MOHRE system. A copy must be provided to the employee. If any condition conflicts with UAE Labour Law, the law prevails. This aligns with Articles 8, 9 and related provisions of the decree-law.

Limited vs Unlimited Contracts

The UAE shifted to fixed-term employment models under Law No. 33 of 2021. Older unlimited contracts were given a transition period. Today, both employer and worker sign a renewable fixed-term contract that normally runs for up to three years.

Limited contracts include:

- Start and end date

- Renewal clause

- Conditions for early termination

Unlimited contracts still exist only in rare legacy cases. All new hires are issued fixed-term contracts registered with MOHRE. If renewed, the contract continues under the same terms unless both parties agree to changes.

Example:

If an employee signs a two-year contract, the employer can renew it for another term without changing the job role unless both agree in writing.

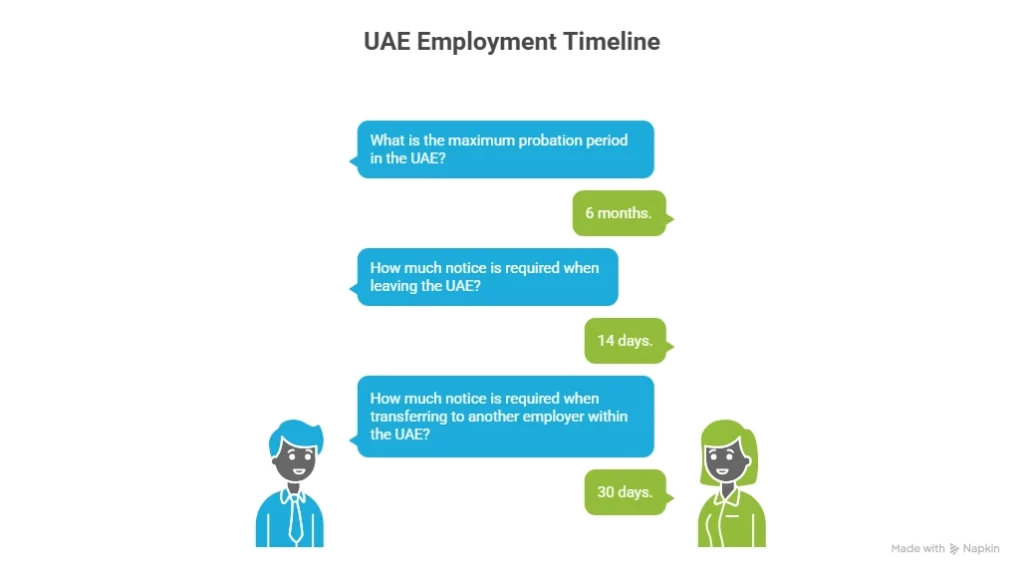

Probation Period Rules

Probation is allowed but strictly controlled. It cannot exceed six months. Workers must be informed in writing.

Key Rules

What is the maximum probation period under UAE Labour Law?

The probation period cannot be longer than six months, and any termination or resignation during probation must follow the written notice rules in Article 9.

Contract Renewal, Revision and Termination Clauses

All contracts can be renewed once they expire. If renewed, the original contract period counts toward total service years. This affects gratuity and other benefits.

Contracts may be amended only through mutual written agreement. Terms cannot be reduced in a way that harms the worker’s rights under the law.

Termination must follow the legal process:

- Written notice period

- Valid legal grounds

- Final settlement

Cancellation of work permits through MOHRE

Any clause that removes basic labour rights is invalid. If an employer or worker fails to honour the notice period without lawful reason, compensation may apply as stated in Articles 43 to 47.

Non-Competition Agreements

Employers may add a non-competition clause when the job role exposes business secrets.

However, the clause must follow clear limits:

- Job type

- Time period

- Geographic scope

It must be reasonable and not prevent the worker from finding suitable employment. Courts review these clauses. If a restriction is too broad or unfair, judges may cancel it under Article 10 of the Labour Law.

Transfer and Outsourcing Regulations

The UAE allows the legal transfer of workers between companies if MOHRE procedures are followed. Transfers must be documented, and the employee’s written approval is required. All outstanding benefits must be settled before transfer.

Outsourcing companies must hold proper licences. They must ensure workers receive fair treatment, salary protection, and insurance even though the worker is assigned to another business site. MOHRE may take action against any company that misuses outsourcing or fails to protect employee rights.

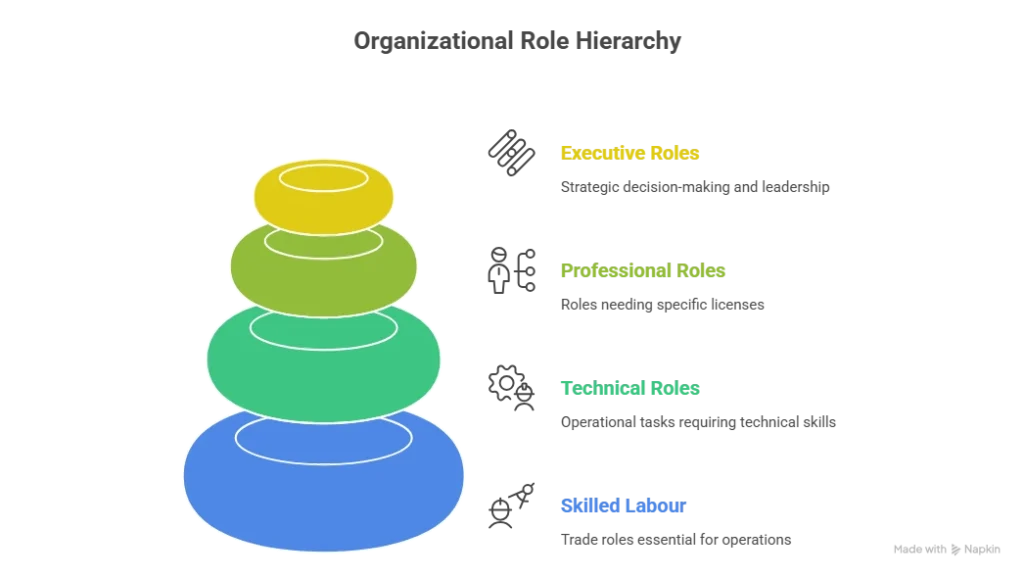

Professional Job Categories & Worker Classification

Understanding how jobs are grouped under the UAE Labour Law helps employers assign roles correctly and gives workers clarity on their rights. Federal Decree-Law No. 33 of 2021 and its executive regulations outline these classifications. This system also supports fair pay, compliance, and transparent hiring.

Category | Examples |

|---|---|

Executive | Directors, senior managers |

Professional | Doctors, engineers, lawyers |

Technical | Supervisors, IT support, operators |

Skilled | Drivers, carpenters, welders |

Executive, Professional, Technical & Skilled Labour Tiers

The law groups private-sector workers into levels based on education, responsibility, and job duties. These tiers help the Ministry of Human Resources and Emiratisation (MOHRE) identify the role of each employee in the labour market.

1. Executive level

These are senior roles with decision-making authority. They handle business strategy, company direction, internal policies, and signing powers. Examples include directors, senior managers, and high-level department heads.

2. Professional level

These positions require specialised education and recognised qualifications. They involve licensed or regulated professions such as engineers, medical staff, lawyers, auditors, architects, and educators.

3. Technical level

These roles demand technical skills or training. The tasks here are more operational and skill-based. Examples include technicians, supervisors, IT support, machine operators, and system controllers.

4. Skilled labour level

These workers perform trades that need skill, training, or vocational certificates. Carpenters, electricians, drivers, plumbers, welders, construction workers, and mechanics fall into this tier.

The identification process also helps determine work permit categories, compliance checks, and eligibility for job transfer. Many organisations use this structure while drafting job roles, HR policies, and pay scales.

Classification Under UAE Legislation Portal

The official UAE Legislation Portal and MOHRE guidelines provide job definitions and list roles within regulated sectors. These frameworks reveal qualification requirements, training expectations, and allowed work types.

Employers must refer to these criteria when preparing contracts or hiring. This ensures correct job titles, valid work permits, and legal compliance. It also helps workers confirm whether their position meets the correct classification, especially when changing companies or applying for skill-based visas.

If a job falls outside the listed role guide, companies must submit supporting documents, such as degrees, experience letters, or professional licenses. MOHRE may verify the information before approving the work permit.

Outsourcing, Freelancers & Recruitment Licensing

The law allows workforce outsourcing and freelance arrangements, as long as regulations are followed. Each model has its own rules.

Outsourced labour

These workers remain employed by an agency but work inside another company. Employers must only use licensed outsourcing bodies approved by MOHRE. Outsourced staff still receive full labour rights such as wages, leave, and end-of-service benefits.

Freelancers

Individuals can work independently under an approved freelance permit. They may take short-term projects or specialised tasks and are not tied to a single employer. Freelancers must hold a valid residency status, fulfil tax and service obligations, and meet any licensing conditions linked to their profession.

Recruitment agencies

Only licensed firms can supply manpower, advertise job vacancies, or conduct hiring services. These firms must comply with worker protection rules, employment contract obligations, fee regulations, and transparent recruitment practices. Charging employees recruitment fees is prohibited under UAE law.

Employers who hire through outsourcing firms or freelance permits must verify licensing, identity, and contract terms. They should keep documentation ready in case MOHRE requests inspection or audit records.

Practical Insight

Example:

A company hiring engineers must classify them under “professional category.” If it hires welders for a construction project, they fall under “skilled labour.” If the same company brings technicians from a licensed staffing agency, those workers are considered outsourced staff but still protected by UAE labour provisions.

Correct classification reduces legal risk, supports balanced hiring, and improves compliance reviews.

Working Hours, Overtime & Weekly Rest in the UAE

The UAE Labour Law sets clear limits on daily and weekly work. These rules protect employees and help employers manage lawful schedules. The main reference is Federal Decree-Law No. 33 of 2021, and its executive regulations.

Topic | Legal Rule |

|---|---|

Normal hours | 8 hours per day, 48 per week |

Ramadan hours | 2 hours less for Muslims |

Overtime rate | Hourly rate + at least 25% |

Night overtime | Hourly rate + 50% |

Weekly rest | Minimum 1 paid day |

Standard Working Hours

In most private-sector companies, the legal working limit is 8 hours per day or 48 hours per week. The employer may reduce hours for hard or hazardous jobs. During Ramadan, Muslim employees must work 2 hours less per day. If a company sets a different schedule, it must stay within these limits unless the role is legally exempt. Any change must appear in the employment contract, internal policy, or official work schedule.

Flexible & Remote Working Models

The law allows several work patterns:

- full-time

- part-time

- temporary

- remote working

- job sharing

Remote or flexible work requires written approval from the employer. Employees must follow working hours, safety protocols, performance targets, and data protection policies while working off-site. If the employer applies flexible hours, overtime and weekly rest rules still apply unless the role falls under special legal categories stated by the Ministry.

Overtime Eligibility and Calculation

When the job demands extra time, overtime compensation applies. Overtime must be assigned formally by the employer and cannot conflict with health rules.

Overtime calculation basics:

- For extra working hours beyond standard time: employee receives basic salary per hour + at least 25%.

- If overtime takes place between 10 PM and 4 AM: employee receives basic salary per hour + at least 50%.

- For work on weekly rest days: employee is entitled to another paid rest day, or pay equal to salary per hour + 50%.

Managers with advisory duties and high administrative roles may be excluded from overtime, but only when their positions fit the legal exemption list. Employers must record worked hours accurately for audit purposes.

Weekly Day-off Entitlement

Every employee must receive at least one paid weekly rest day. The default rest day is Sunday, but the employer may assign a different day if business needs require it. Any permanent change should be shared with staff in writing.

Employees cannot be denied rest without compensation. If they work on their weekly day off, the employer must grant either an alternative paid rest day or the legally required overtime pay.

What are the standard working hours in the UAE private sector?

Standard working hours are usually 8 hours per day or 48 hours per week for most private sector employees, with shorter hours for Muslims during Ramadan.

Wages, Payment Regulations & Minimum Salary Requirements

The UAE Labour Law sets clear rules for how wages must be calculated, paid, and protected. These rules help workers receive their salaries on time and give companies a transparent system to follow. They appear in Federal Decree-Law No. 33 of 2021 and its executive regulations issued by the Ministry of Human Resources and Emiratisation (MOHRE).

Wage rules apply to workers in the private sector. They also apply to most free-zones, except those that run under their own employment frameworks.

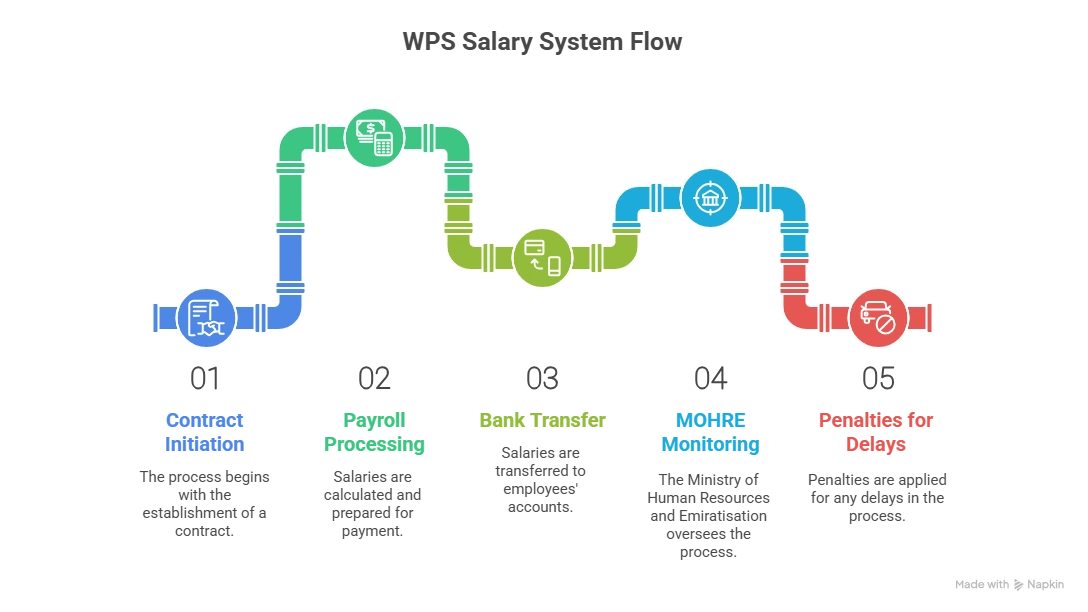

Wage Protection System (WPS)

The Wage Protection System is an electronic salary monitoring system managed by MOHRE and the Central Bank of the UAE. Its purpose is simple. It ensures workers get paid the exact salary shown in their employment contract, through registered banks and exchange houses.

All active companies must register in WPS. Failure to join it, or failure to pay wages through it, leads to penalties.

Key Points

The system protects employees from unfair deductions and unrecorded salary handovers. It provides the government with proof of complete payment.

Minimum Wage Rules

Federal Decree-Law No. 33 of 2021 states that the UAE Cabinet has authority to set minimum wage figures. The law also requires companies to mention salary components clearly in the employment contract. These include basic wage and any allowances agreed between both sides.

The UAE focuses on fair income standards, especially for skilled professionals. Minimum wage decisions are issued through Cabinet Resolutions when needed. Workers must receive wages aligned with their job category, contract role, and requirements in their labour permit.

For young workers and trainees, employers must also comply with special protection conditions mentioned in the law.

Salary Delays, Deductions & Penalties

Salary delays

If an employer does not pay salary on time through WPS, the company may face restrictions. These include inspection referrals, penalties, or suspension of labour services.

Salary deductions

Deductions are only legal when they follow the conditions mentioned in the law. They may include:

- repayment of loans

- fines for proven violations

- advance salary payments

- recovery of unearned wage

Any other deduction must align with MOHRE rules. Employers cannot reduce wages without a legal basis. Workers also have the right to register wage complaints when payment becomes overdue.

Penalties

If violations continue, the company can face:

- financial fines

- operational restrictions

- labour dispute referrals

These measures maintain national wage stability and transparency.

Currency of Salary Payments

Wages must be paid in the UAE Dirham (AED). The law requires companies to respect payment schedules and keep accurate records. Salary details must match the employment contract filed with MOHRE.

This fixed currency rule supports clarity in final settlements, gratuity calculations, deductions, and overtime entitlements. It helps prevent disputes and supports accurate financial documentation.

Employee Leaves & Holidays Under UAE Labour Law

Employees working in the UAE have clear rights to leave and holidays. These rights are based on Federal Decree-Law No. 33 of 2021, and its executive regulations issued by the Ministry of Human Resources and Emiratisation (MOHRE). The purpose is to protect workers’ wellbeing and maintain a healthy work environment.

Employees should always check their signed contracts, because benefits cannot be less than the minimum legal limits.

Annual Leave Entitlement

Employees who complete one full year of service earn paid annual leave. The minimum entitlement is 30 calendar days per year for full-time workers. Workers who did not complete a full year earn leave proportionally, based on their completed service period. Annual leave can be split if both sides agree. Employers must set the schedule after considering operational needs and the employee’s personal situation.

Unused annual leave must be paid at the end of service at the basic salary rate. If the employee worked part-time or under other work models, the leave entitlement is calculated by contract terms and executive regulations.

Reference: Federal Decree-Law No. 33 of 2021, Article 29.

How much annual leave do employees get in the UAE?

Full‑time employees who complete one year of service are entitled to at least 30 calendar days of paid annual leave per year under Article 29.

Public Holidays

Employees are entitled to official public holidays announced by the UAE Government. These include national and religious events, such as National Day, Eid Al Fitr and Eid Al Adha. When required to work on an official holiday, workers must receive either a replacement day off or additional payment. This is based on MOHRE regulations related to holiday work compensation.

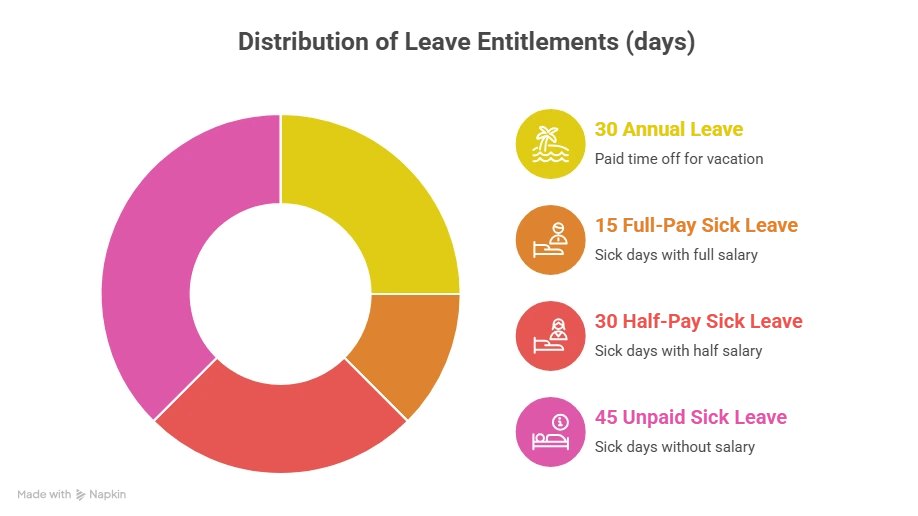

Sick Leave

Employees who complete the probation period earn sick leave benefits. The employee must notify the employer and present medical reports issued by approved medical establishments.

Maximum sick leave per year is 90 days, applied in the following pattern:

- First 15 days are paid at full salary

- Next 30 days are paid at half salary

- Remaining 45 days are unpaid

If the illness results from unlawful acts or misconduct, leave may be rejected. Employers cannot terminate employees solely because they use their entitled sick leave.

Reference: Federal Decree-Law No. 33 of 2021, Article 31.

Maternity, Paternity & Compassionate Leave

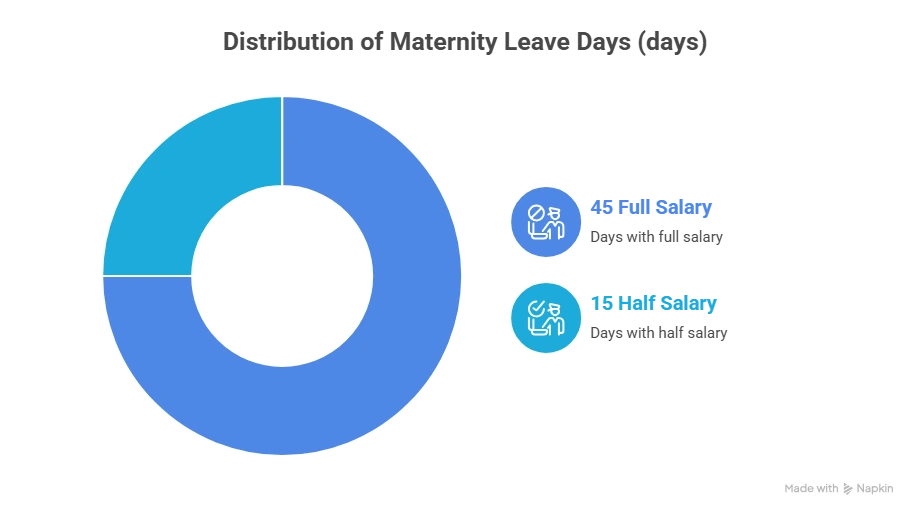

Maternity Leave

Female employees are entitled to paid maternity leave of 60 days. This is divided as:

- First 45 days at full salary

- Next 15 days at half salary

Additional unpaid leave may be requested if medical conditions are proven. The law does not allow reducing maternity leave rights under any contract. Breastfeeding breaks are also granted for a fixed period after returning to work, based on executive regulations.

Paternity Leave

Male employees have a right to paternity leave. This allowance can be taken within a defined period after childbirth, as described in ministerial decisions.

Compassionate Leave

Employees can take compassionate leave when an immediate family member passes away. The number of days depends on the degree of relation. These limits are mentioned in the UAE Labour Law and its executive regulations.

Leave Without Pay & Absence After Leave

Employees may request unpaid leave if agreed in writing. The employer is not required to approve it unless terms in the employment contract allow it. If a worker does not return after an approved leave period, the days of absence may be deducted.

Disciplinary actions may apply if the absence is unjustified. End-of-service benefits are calculated only on paid periods of service. Long unpaid leave may reduce the total service balance unless stated otherwise by the law.

Practical Example

A full-time employee completes two years of service. If their approved annual leave is 30 days per year, they earned 60 days over two years. If they did not use any days, they must receive payment for 60 days of annual leave at the basic salary rate when leaving the job.

Important Notes

Workplace Rights, Equality & Safety Regulations

UAE Labour Law sets clear rules to protect workers, prevent discrimination, and ensure safe workplaces. These protections apply to all private-sector employees under Federal Decree-Law No. 33 of 2021 and its executive regulations. The law requires fair treatment, equal pay, safe working conditions, and access to grievance systems.

Below are the core principles employers and employees must understand

Non-Discrimination & Equal Pay Principles

The Labour Law prohibits all forms of discrimination in hiring, wages, promotion, training, or termination. Employers must treat workers fairly, regardless of gender, nationality, religion, social status or disability. Article 4 of the Federal Decree-Law confirms this protection.

Women performing work of equal value must receive equal salaries. This rule is reinforced by UAE Cabinet Resolution No. (1) of 2022 on “Equal Wage for Equal Work”. Employers cannot reject applicants due to disability if the individual is medically fit to perform job duties.

Bullying, Harassment & Abuse Prevention

Workplaces must remain respectful and free from violence, threats, or exploitation. The UAE law bans physical, verbal or psychological abuse, including sexual harassment. Article 14 of Decree-Law No. 33 directs employers to prevent misconduct and protect dignity at work.

Employers must introduce internal policies that define misconduct, report channels, disciplinary steps, and support systems for affected workers. Workers can file complaints with MOHRE if they experience harassment or retaliation after reporting an issue.

Occupational Health & Safety Standards

Employers are responsible for providing safe workplaces, proper tools and risk-free environments.

Article 36 requires companies to:

- Train workers on occupational safety

- Provide protective equipment

- Reduce risks of physical harm

- Apply preventive and emergency measures

- Maintain workplace hygiene

Regular safety drills, equipment maintenance and hazard assessments are essential parts of compliance. Employers must review safety standards whenever work conditions change. If a worker identifies unsafe practices, the concern should be raised with HR or the direct supervisor. MOHRE may also inspect sites to ensure compliance.

Workplace Injury Compensation Policies

Workers injured while performing their duties are entitled to medical care and compensation. Article 37 describes these rights and sets rules for benefits.

Key points

Cases where compensation does not apply are defined in Article 38. These include injury caused by intoxication, disregard for safety controls, or acts unrelated to duty. Employers are still required to investigate incidents, document findings, and file reports with authorities if required.

End-of-Service Benefits & Gratuity Calculation

End-of-service benefits in the UAE are governed under Article 51 of Federal Decree-Law No. 33 of 2021. These benefits compensate workers at the end of employment. Employers must calculate gratuity based on the worker’s basic salary and total years of service. Full benefits apply only when the worker completes at least one full year of continuous service.

Basic salary excludes allowances, commissions, bonuses, or housing. The law requires that payments are settled immediately after the end of contract, unless otherwise agreed in writing.

Gratuity Rules for Limited Contracts

Under a limited contract, gratuity is based on a fixed daily rate. The formula used by HR and legal departments is:

- > Daily rate = Basic salary ÷ 30

- Where “30” is the standard divisor under UAE law.

Once the daily rate is known, gratuity days are added based on total service years:

- Years of Service Gratuity Days Per Service Year

- Up to 5 years 21 days per year

- More than 5 years 30 days per year

Example

Basic salary: AED 6,000

Completed service: 6 years

Step 1: 6,000 ÷ 30 = AED 200 per day

Step 2: Days entitlement

First 5 years: 5 × 21 = 105

Additional year: 1 × 30 = 30

Total: 135 days

Step 3: 135 × 200 = AED 27,000

How is gratuity calculated in UAE?

Gratuity is usually calculated as basic salary divided by 30, then multiplied by 21 days per service year up to five years and 30 days per service year after five years, subject to the rules in Article 51.

The same rule applies whether the worker resigns or the employer ends the contract, as long as there is no misconduct under Article 44.

Gratuity Rules for Unlimited Contracts

Unlimited contracts used the same entitlement formula after the 2022 labour reforms. Past reductions linked to resignation were removed by the Ministry. Today, the law requires calculating gratuity on full entitlement once one full service year is completed.

Rules are:

- Up to 5 years: 21 days per year

- Above 5 years: 30 days per year

Example

Basic salary: AED 4,500

Service period: 4 years and 2 months

Daily rate: 4,500 ÷ 30 = AED 150

Days entitlement: 4 × 21 = 84

Gratuity: 84 × 150 = AED 12,600

Short partial years are converted on a proportional basis using total days worked.

Resignation vs Termination Gratuity Laws

If a worker resigns or is terminated without misconduct, the entitlement remains the same under Article 51. However, misconduct proven through MOHRE can lead to losing gratuity. These cases follow Article 44.

Reasons that may reduce or cancel gratuity:

- Fraud or forged documents

- Disclosure of confidential data

- Absence without valid reason

If termination is unlawful, such as discrimination, complaint filing or maternity-related dismissal, the worker keeps full entitlement. When termination is due to medical inability, workers are still paid gratuity for completed service.

Gratuity for Part-time, Contract & Flexible Models

The UAE Labour Law allows different work models, including temporary, part-time, job-share, and flexible contracts. Article 52 explains how gratuity applies in these cases.

Workers under these models receive end-of-service benefits calculated proportionally on actual working days. The Ministry formula used by legal practitioners is:

- > (Basic salary ÷ 30) × eligible annual days × (actual working days ÷ 365)

- Where eligible annual days are 21 or 30, based on total service period.

Example

Basic salary: AED 7,000

Worked 2 years on part-time basis

Actual working time: 50 percent load

Daily rate: 7,000 ÷ 30 = AED 233.33

Days entitlement: 2 × 21 = 42

Time ratio: 50 percent

Gratuity: 42 × 233.33 × 0.50 = AED 4,900 approx

When does gratuity NOT apply?

Under Article 39 and 44:

Employers must prove violations, otherwise benefits remain payable.

Employer’s responsibility

The employer must:

- Calculate gratuity accurately

- Settle final dues promptly

- Provide breakdown upon request

- Share calculation method

Failure to settle end-of-service rights can lead to fines under ministerial resolutions and MOHRE dispute referrals.

Termination of Employment Under UAE Labour Law

Employment termination in the UAE is regulated under Federal Decree-Law No. 33 of 2021 and its 2022–2024 executive updates. The law ensures clarity for both sides, protects workers from unfair dismissal, and sets procedural rules employers must follow before ending any contract. MOHRE recognises multiple grounds for ending employment. Each case carries rules on notice, settlement rights, and eligibility for benefits.

Legal Notice Period Requirements

Notice is required when either party ends a valid contract. The standard notice period ranges between 30 and 90 days. Both employer and employee must comply with the written notice clause mentioned in the labour contract.

Key Rules

Rule | Requirement |

|---|---|

Notice must be written | Yes |

Range allowed | 30 to 90 days |

Salary during notice | Full pay |

Payment in lieu allowed | Yes |

Mutual reduction | Written agreement only |

If an employer ends the contract with proper notice, the worker remains entitled to:

- pending wages

- unused leave balance

- gratuity (if applicable)

Reference: Federal Decree-Law No. 33 of 2021, Art. 43.

Termination Without Notice

The law allows immediate termination without notice only in specific cases. This applies when a party commits a violation defined in the executive regulations.

Examples include:

- submitting forged documents

- workplace misconduct

- disclosure of sensitive corporate data

- repeated breach of duties after warnings

Employers must justify these reasons and show supporting evidence if challenged at MOHRE. Employees may also resign without notice when:

- employer fails to pay salary for more than 60 days

- serious safety risks exist

- employer breaches contract obligations

Reference: Art. 44 & Art. 45.

Unlawful & Arbitrary Dismissal

Dismissal is unlawful when it is motivated by reasons unrelated to job performance or misconduct.

Common unfair cases include:

- dismissal for filing a labour complaint

- dismissal during a legal case

- dismissal due to discrimination or retaliation

If a worker proves arbitrary dismissal, MOHRE may order compensation through the court. Compensation levels consider job role, service duration, and actual loss.

Reference: Art. 47.

Employee Abandonment Rules

Leaving the workplace without formal notice may be treated as abandonment. In such cases, the employer must report the incident to MOHRE within the required period.

Consequences may include:

- loss of end-of-service benefits

- labour bans in serious violations

- recovery of damages if proved by employer

The law still requires employers to keep written evidence before claiming abandonment.

Termination Due to Medical Inability

If medical reports officially confirm that the worker can no longer perform duties, the employer may end the contract. Before termination, the worker must receive full sick leave entitlement as stated in Art. 30 and 31.

Upon lawful termination, the employee remains entitled to:

- service benefits

- pending dues

- any approved allowances

Contract Continuity & Worker Transfer

The UAE allows workers to move to another employer once a contract ends. MOHRE ensures the worker’s right to continue employment in the country without sponsor restrictions.

Rules include:

- settling final dues

- issuing experience certificates

- cancelling work permit in MOHRE system

- providing transfer approval if applicable

The law bars employers from obstructing employee transfer, delaying clearance, or withholding personal documents.

Reference: Art. 48 & Art. 49.

Short Example

Case: A worker resigns with 30-day notice because salaries were delayed for over two months.

Result: The resignation is valid, and no penalties apply. The worker must still serve the notice unless MOHRE confirms a severe breach by the employer.

Tip for HR and Employers

Always document:

Proper documentation protects both sides in any dispute.

Employee Resignation & Exit Process Under UAE Labour Law

Resignation in the UAE must follow the rules set in Federal Decree-Law No. 33 of 2021 and its Executive Regulations. The law protects both parties and ensures a clean and lawful exit from employment.

Below is a simple and legally compliant explanation of every requirement.

Proper Legal Steps to Resign

Employees must follow these core steps to leave a job lawfully:

1. Submit a written resignation notice It must be clear and dated. Electronic submission is also valid. Notice periods depend on the contract, but the normal range is 30 to 90 days.

2. Serve the agreed notice period The notice must comply with Article 43. Both parties can agree to shorten the notice in writing.

3. Complete work during the notice period. The worker must continue their duties until the last day.

4. Handover company assets. Examples: laptop, ID card, documents, project files.

5. Final payroll compliance through WPS. The employer must process end salary through the Wage Protection System if applicable.

Reference: Ministry of Human Resources & Emiratisation (MOHRE) policy guides.

Required Documents

Below are the most common documents that employees may ask for at exit, under Article 53 and ministry guidelines:

- End-of-service statement

- Experience certificate

- Salary certificate if needed

- Final payslip

- Labour contract copy

- Proof of service duration

These documents protect the employee and support future work, visa applications, or legal requests.

Document | Purpose |

|---|---|

Experience certificate | Proof of work duration |

End‑of‑service statement | Final dues & benefits |

Salary certificate | Bank, visa, legal use |

Contract copy | Reference for disputes |

Final payslip | Payment breakdown |

Resignation During Probation

Article 9 explains the rules for probation resignation.

If the employee resigns for a new employer inside the UAE:

- A written notice of minimum 30 days is required.

- The new employer may need to reimburse recruitment expenses to the old employer.

If the employee resigns to leave the UAE:

- They must give 14 days’ written notice.

Probation resignation still requires proper notice, unless waived in writing.

Immediate Resignation (No Notice Cases)

The law allows resignation without notice if certain legal violations occur.

Examples under Articles 14, 25 and 45, depending on the case:

- The employer commits assault, violence or harassment

- Significant workplace danger is proven and not corrected

- Employer breaches contract terms

- Wages are not paid for more than 60 days

In these cases, the employee can resign without serving the notice period after formally reporting the issue. MOHRE complaint channels can be used if needed.

Final Settlement Rights

After the contract ends, the employer must:

- Pay all due salaries

- Pay unused leave balance according to payroll records

- Pay gratuity (if the employee completed at least one year)

- Release experience documents

- Cancel the work permit

The settlement must follow Articles 51, 52, and 53, based on the worker’s employment category. Final settlement must be paid within the legally accepted timeframe and includes all approved dues.

End-of-Service Documentation & Employer Obligations

Experience Certificates

When an employee leaves a job, the employer must issue an official experience certificate. This document confirms the employee’s full working duration, job title, and duties. It should not include negative remarks or any language that harms future opportunities.

Key requirements

Many workers need this certificate when applying for visas, new jobs, or legal claims. Failing to issue one can lead to labour complaints with MOHRE.

Salary Certificates

A salary certificate may be required for bank loans, immigration matters, or financial verification. Employees can request it at any time. It must clearly show the basic salary and other contractual allowances.

The certificate usually includes:

- Full name of employee

- Basic salary

- Allowances mentioned in the contract

- Company letterhead and stamp

Employers are expected to provide accurate figures as documented in the Ministry’s systems.

Final Payslip

At the end of service, the worker is entitled to a final payslip. This slip summarises all payments and deductions up to the last working day.

It must reflect:

- Remaining salary

- Leave encashment if applicable

- Gratuity amount

- Any deductions that are legally permitted

The payslip supports transparency and helps prevent disputes. It is often required when opening labour cases.

Contract Cancellation

When the employment ends, the employer must cancel the contract officially. This is completed through the UAE labour system integrated with MOHRE. Cancellation ensures the worker is released from the establishment, and allows future employment.

Important points:

- Employer should not delay cancellation once dues are cleared

- Any hold applied without reason can be challenged through a labour complaint

- Cancellation triggers the end-of-service benefits process

Once cancelled, the worker may transfer to another company or exit the country based on visa status.

Work Permit Cancellation

The work permit is cancelled after contract termination. This process is also a responsibility of the employer. It must be done within the legal timeline after paying the employee’s dues.

After cancellation:

- The employee may transfer sponsorship if eligible

- The visa cancellation process may begin as well

- The individual must comply with residency rules during the grace period

- MOHRE rules are designed to prevent exploitation and ensure a clean exit process.

Practical value for readers

Visa, Work Permit & Employment Mobility Laws

The UAE Labour Law regulates work permits, visas, employee transfer rights, and immigration compliance. These rules are issued under Federal Decree-Law No. 33 of 2021, its Executive Regulations, and the guidelines of the Ministry of Human Resources and Emiratisation (MOHRE).

They apply to all private-sector workers, unless a free zone has its own labour framework.

Issuing and Renewing Work Permits

Every employee must hold an approved work permit before starting work. MOHRE issues these permits after verifying job offers, qualifications, and employment contracts.

Common work permit types include:

- Standard employment permit

- Part-time permit

- Temporary employment permit

- Freelance permit

- Student training permits

Employers must:

- Submit work contracts within the legal time

- Pay permit fees on time

- Ensure the job title matches actual duties

- Renew work permits before expiry

Validity

Most permits follow contract duration. If the contract ends, the permit must be cancelled or renewed based on a new offer.

Visa Cancellation Procedures

When employment ends, the visa linked to that employment must be cancelled.

MOHRE and the Federal Authority for Identity, Citizenship, Customs and Ports Security (ICP) manage this process.

Steps followed by most employers:

- Final salary settlement

- MOHRE contract cancellation request

- Work permit cancellation

- Residence visa cancellation under ICP

An employee can request cancellation if the employer unreasonably delays it. After cancellation, a grace period applies so the person may exit the UAE or take another job.

Employee Transfer Rights Post-Contract

The current labour law supports employment mobility. An employee can move to another company after their contract ends, or after lawful resignation with notice.

Transfers are allowed when:

- All dues are paid

- Work permit is cancelled

- New employer issues a fresh offer and MOHRE approval

Blocking transfers is not permitted except in cases of proven violations or misuse of rights.

MOHRE can also allow transfer without employer consent in limited situations such as:

- Labour disputes

- Wage delays

- Contract breaches

Immigration Compliance

Employers must meet federal immigration and labour compliance duties.

These include:

- Keeping valid permits

- Recording contract changes

- Observing visa expiry dates

- Updating establishment data

- Respecting Emiratisation quotas where applicable

Failing to follow these rules may lead to:

- Fines

- Suspension of labour file

- Ban on new permits

Workers must also comply by:

- Working only for the permitted employer

- Respecting visa terms

- Avoiding unauthorized jobs

These rules ensure a fair and transparent system for both parties, while safeguarding the UAE’s labour market integrity.

Emiratisation Requirements

Emiratisation is a national hiring system. It increases UAE citizens’ employment in private companies.

Policy Purpose

The UAE introduced Emiratisation to strengthen national participation in the workforce. It ensures fair access to skilled roles. It supports long-term economic stability and knowledge growth. Compliance is supervised by MOHRE and related government entities.

Percentage Requirements by Company Size

Private companies must employ a defined quota of UAE nationals. The quota depends on activity and workforce size. Most companies with 50+ employees must raise Emiratisation by 2% yearly in skilled jobs.

Targets may differ between sectors and company classifications. The latest rules are published by MOHRE.

Penalties for Non-Compliance

Non-compliant firms face fines and restrictions. Penalties can include monthly fines, contract limits, or licence blocks. Companies may also lose access to government services. The fine structure and deadlines are set by ministerial resolutions.

Nafis Programme Overview

Nafis is a government support programme. It helps national job-seekers and supports private firms in hiring them. It offers salary support, training, and career development tools. Companies that meet Emiratisation targets may receive incentives.

Labour Disputes, Arbitration & Legal Claims in the UAE

The UAE Labour Law sets a clear process for handling workplace disputes. It gives both parties fair access to resolution channels through the Ministry of Human Resources and Emiratisation (MOHRE) and the UAE courts.

The goal is fast, documented, and lawful settlement.

Labour Inspection

MOHRE officers carry out workplace inspections to check compliance with labour rules.

They may review:

- employment contracts

- wage payment records

- working condition safety

- recruitment practices

Health and safety checks can involve site visits, interviews, and document requests. If a breach is found, the Ministry can issue warnings, corrective orders, or penalties under Federal Decree-Law No. 33 of 2021.

Filing Complaints with MOHRE

Employees and employers can file complaints for labour disputes such as:

- unpaid wages

- wrongful termination

- contract violations

- harassment

- leave disputes

- work injury claims

Complaints are filed through:

- MOHRE service centers

- the MOHRE app

- or the call center

The Ministry acts as a first mediator before allowing the matter to move to court.

Required details usually include:

- Emirates ID

- employment contract copies

- salary slips or WPS records

- correspondence related to the dispute

Complaint Type | Examples |

|---|---|

Wage violations | Delayed salary, WPS breach |

Contract disputes | Role change, benefit cuts |

Wrongful termination | No legal grounds |

Harassment claims | Verbal or physical abuse |

Leave disputes | Annual, maternity, injury |

MOHRE reviews the case and arranges a mediation session.

Mediation & Court Path

Most disputes are settled during MOHRE mediation. If no agreement is reached, the case is transferred to the labour court.

The Ministry issues a written report that summarises:

- dispute subject

- evidence provided

- mediation results

The employee or employer can then file the case in court with that report attached.

Courts may review:

- contract terms

- payroll records

- injury reports

- company policies

Judgments can include compensation, reinstatement orders, or penalties if violations are proven.

Fee Exemption Rules

Workers do not pay court fees for claims below a certain financial limit set by UAE law. This rule ensures employees can defend their rights without financial pressure.

For example, claims linked to unpaid salaries or gratuity often fall under the exemption.

Timelines & Documentation

Labour complaints should be filed within time limits set by relevant procedures. Quick action helps preserve evidence and protects legal rights.

Common documents requested:

- approved labour contract

- WPS salary records

- termination letters

- medical or injury reports

- attendance sheets

- warning notices

Well-prepared documentation supports stronger case outcomes in both mediation and court review.

How can employees file a labour complaint in the UAE?

Employees can file a labour complaint with MOHRE through service centres, the MOHRE app, or the call centre, and the Ministry will first try to resolve the dispute through mediation.

Penalties, Violations & Non-Compliance for Employers

The UAE Labour Law sets firm penalties to keep workplaces fair and safe. These rules apply to private sector companies across the country. MOHRE monitors compliance and can take action if an employer breaks the law.

Wage Delays

Workers must receive salaries on time. Payments are made through the Wage Protection System (WPS).

If a company delays salaries without a valid reason, MOHRE may:

- issue warnings

- freeze new work permits

- refer the matter for legal action

Repeated violations can also lead to fines or suspension of business services. These rules protect workers from financial hardship.

Non-Contractual Practices

Employers must follow the agreed contract terms. Changes to job roles, salary, or work location require employee consent.

Violations include:

- forcing extra duties not listed in the contract

- cutting wages without approval

- withholding legal benefits

MOHRE can order corrections and apply penalties. Persistent breach may also expose the employer to labour claims.

Harassment & Discrimination Penalties

The law prohibits workplace discrimination, threats, and harassment. Employees must be treated with fairness, regardless of gender, race, religion, or disability.

If misconduct occurs, consequences may include:

- legal investigation

- fines

- disciplinary measures

- civil liability

Workers can file complaints if they face mistreatment at work. Employers are expected to provide a respectful and safe workplace.

Failure to Provide Insurance & Safety Measures

Companies must protect workers from risks at work. This includes training, safety tools, and clear procedures.

If an employee suffers injury due to unsafe conditions, the employer may face:

- compensation claims

- penalties under Federal Decree-Law No. 33 of 2021

- inspection enforcement by MOHRE

Workplaces must follow national safety standards. Accident records and medical support should be properly maintained.

Violation | Possible Action |

|---|---|

Salary delay | Freeze permits, fines |

Discrimination | Legal investigation |

Unsafe workplace | Compensation claims |

Hiring without permits | Licence action |

Contract breaches | MOHRE orders or fines |

Special Labour Categories in UAE Labour Law

The UAE Labour Law sets specific rules for certain worker groups. These categories have extra protection, documentation needs, and compliance conditions. The main groups include juveniles, domestic workers, part-time employees, freelancers, and outsourced staff.

Juvenile Employment Rules

Workers under 15 are not allowed to work. From age 15 to 18, employment is allowed with restrictions.

Basic legal rules:

- Work must not risk health, safety, or morals.

- Night shifts, industrial work, and overtime are not allowed.

- Written consent from a guardian is required.

- A medical fitness certificate is mandatory.

Employers must:

- Keep identity documents on record.

- Follow the working hours limit set by the Ministry of Human Resources and Emiratisation (MOHRE).

(Reference: Article on Juvenile Employment under Federal Decree-Law No. 33 of 2021)

Domestic Workers

Domestic workers are regulated under separate legislation. They include helpers, drivers, nannies, cooks, gardeners, and private staff.

Key protections

Employers must:

- Provide decent accommodation.

- Pay wages on time.

- Respect personal dignity and privacy.

Domestic workers are protected from:

- Forced labour.

- Confiscation of documents.

- Physical or verbal abuse.

(Reference: UAE Domestic Workers Law, Federal Law No. 10 of 2017)

Part-Time & Freelancers

Part-time employees and freelancers can legally work for more than one employer. A valid work permit is required through MOHRE.

Key rules

Freelancers can:

- Offer services independently.

- Work for multiple businesses.

- Operate under a licence based on their activity category.

Employers remain responsible for:

- Contract terms.

- Working conditions.

- Workplace safety obligations.

Outsourced Labour

Outsourced workers are hired through licensed agencies. They can legally work inside another establishment.

Regulatory requirements:

- The agency must hold an approved licence.

- The primary employer must ensure wage protection.

- Health and safety policies must be followed at the actual workplace.

- Workers should not face lower rights than in-house staff.

The hosting company is responsible for:

- Safe environment.

- Equal treatment in facilities.

- Compliance with working hours and rest days.

The law bans any practices that exploit outsourced workers or restrict movement.

(Reference: MOHRE recruitment and outsourcing regulations)

Executive Regulations of UAE Labour Law

The Executive Regulations explain how the main UAE Labour Law should be applied in real workplaces. These rules are mostly issued by the Ministry of Human Resources and Emiratisation (MOHRE) under Ministerial and Cabinet Resolutions. They convert legal articles into practical procedures that employers and employees must follow.

Official Ministerial Resolutions

MOHRE issues Ministerial Decisions to interpret and enforce Federal Decree-Law No. 33 of 2021, along with later amendments such as 2022 and 2024 updates.

These decisions cover core topics like:

- approved employment contract templates

- internal disciplinary procedures

- work permit applications

- leaves and attendance rules

- insurance protections

- penalties for non-compliance

Employers must track the latest decisions published on MOHRE’s official portal.

Important Reference:

- Federal Decree-Law No. 33 of 2021

- Cabinet Resolution No. 1 of 2022 (Executive Regulations)

Classification of Establishments

The Regulations classify private companies based on compliance, activity, and workforce policies.

MOHRE assigns rating levels considering:

- Emiratisation commitments

- timely salary payments through WPS

- labour rights compliance

- absence of violations

- transparent employment contracts

Higher category companies receive advantages such as reduced fees and faster approval processes. Companies that ignore obligations risk penalties, fines, and category downgrade.

Internal Labour Regulations

Internal rules govern daily workplace operations. They must match the Labour Law articles and reflect Executive Regulations.

Policies include:

- Code of conduct

- Disciplinary steps

- Workplace safety standards

- Complaint reporting channels

- Attendance and leave rules

- Harassment and discrimination procedures

MOHRE may request proof of these policies during inspection. In case of conflict, national law always prevails.

Emergency Circumstances

Executive Regulations guide employers during emergencies such as:

- business disruptions

- natural disasters

- national instructions

- sudden operational changes

Employers may adjust working hours, work locations, or duties, if reasonable and lawful. These measures must still respect worker rights and safety obligations. During emergencies, MOHRE instructions override internal policies.

International Labour Agreements & Treaties by UAE

ILO Standards

The UAE aligns many labour protections with core International Labour Organization principles. These include fair treatment, safe working environments, and policies that prevent forced labour. These standards also support equality and workplace dignity. Federal Decree-Law No. 33 of 2021 reflects these human rights values by requiring lawful contracts, wage guarantees, and non-discriminatory practices.

Cross-Border Worker Rights

The UAE hosts a large expatriate workforce. Labour regulations therefore apply to employees regardless of nationality. Protection includes written employment contracts, access to complaint channels, paid entitlements, and safe accommodation where required. Authorities such as the Ministry of Human Resources and Emiratisation monitor recruitment agencies to ensure ethical hiring and transparent job offers.

Workers can report disputes directly through MOHRE if they face denied wages, unlawful termination, or unsafe conditions. Multiple embassies and consulates also coordinate with UAE officials to safeguard citizens working in the country.

Compliance Commitments

Employers must comply with national legislation as well as treaties that support worker rights. Key expectations include clear contracts, legal working hours, paid leave, and prompt wages. Recruitment firms must follow licensing requirements and avoid charging fees from workers. Companies found breaching these laws can face fines, licence suspension, or criminal penalties.

Authorities continue updating employment policies to match international best practices. This includes improvements in digital dispute filing, mobility rights, insurance systems, and equal pay measures.

Latest Amendments & Updates (2024 – 2025)

New Resignation Rules

Recent changes clarified resignation rights. Employees can resign with written notice as set in their contract. The law protects workers against pressure or forced resignations. MOHRE ensures that resignation terms remain fair.

Gratuity Law Adjustments

End-of-service rules apply to all full-time private workers. Gratuity is paid based on basic salary and service period. Latest amendments reinforced that gratuity cannot be reduced unfairly. MOHRE Federal Decree-Law No. 33 of 2021 confirms the entitlement.

New Emiratisation Policies

Mandatory Emirati hiring targets apply to many private companies. Percentages vary based on company size. Penalties apply when targets are ignored. The Nafis system supports hiring and training programmes for nationals.

Contract Model Changes

The law shifted from unlimited contracts to fixed-term models. Terms, renewal rules, and limits must be clear and in writing. Employees should receive contract copies. Changes must follow MOHRE standards.

Employer Obligations Updates

Employers must provide safe workplaces, written contracts, and timely wages. Working hour limits, leave entitlements, and equality principles must be followed. Breaches can lead to fines. MOHRE may also take legal action for repeated violations.

Update Type | Short Note |

|---|---|

Resignation rules | Clarity on notice and protection |

Gratuity rules | Equal treatment, no deductions |

Emiratisation | Penalties and yearly growth targets |

Contract models | Shift to fixed terms |

Employer duties | Wage, safety, documents, compliance |

Conclusion

UAE Labour Law gives a clear roadmap for fair work in the private sector. It protects employees, guides employers, and supports a stable labour market.

Keep these points in mind:

- Always read your contract and check it matches UAE Labour Law.

- Know your rights on hours, leave, salary, and end-of-service benefits.

- Use official sources like MOHRE and the UAE Legislation Portal for updates.

If anything feels unclear or unfair, ask HR first. For serious issues, speak with MOHRE or a qualified labour lawyer in the UAE.