JAFZA Gratuity & Final Settlement – Complete Guide with Calculator

Calculating your JAFZA gratuity…

JAFZA Gratuity Result

Breakdown

JAFZA full form Jebel Ali Free Zone is one of the largest free zones in Dubai. It sits near Jebel Ali Port, which is one of the busiest ports in the region. Many global companies use this area for trade, storage, and logistics.

The free zone supports businesses with simple rules and fast services. DP World manages the port and works closely with JAFZA to support smooth trade flow. This location makes it easy for companies to move goods, hire staff, and run daily operations without delays.

JAFZA follows its own employment structure, but workers still receive core protections under UAE labour regulations. This mix gives companies flexibility while keeping employee rights clear.

What Is JAFZA Gratuity And End Of Service Benefits?

JAFZA gratuity is the final payment a worker receives after leaving a company in the Jebel Ali Free Zone. It is a legal right for employees who complete at least one full year of service. The amount reflects the worker’s basic salary and the total period spent with the employer.

In JAFZA, end-of-service benefits follow the general UAE Labour Law, Federal Decree-Law No. 33 of 2021, unless a JAFZA policy adds a special rule. Workers receive gratuity, payment for any earned leave, unpaid salary, and other approved dues when the contract ends.

Employees who are working other than JAFZA, can calculate gratuity while using gratuity calculator Dubai.

JAFZA End Of Service Benefits vs Gratuity Only

Gratuity is only one part of what a worker receives at the end of employment in JAFZA. The full settlement can include several items. Each item must match the records kept in the company’s HR and payroll system.

Gratuity amount

This is the main payment. It is based on basic salary and confirmed service years.

Unpaid salary

If any month or part of a month is pending, it is added to the final settlement.

Payment for unused leave

Any approved leave balance is paid in cash. HR uses the basic salary rate for this calculation.

Allowed deductions and advances

Companies may deduct only what the law allows, such as confirmed loans, salary advances, or amounts linked to proven losses.

Other agreed payments in the final settlement

This can include commissions, incentives, or contract-based amounts that became due before the last working day.

Legal Base For JAFZA Gratuity

The gratuity system in JAFZA follows the core rules set under UAE Labour Law, mainly Federal Decree Law No 33 of 2021. The law explains how end of service benefits are earned, calculated, and paid. JAFZA uses these national rules, then adds its own internal procedures for companies inside the free zone.

Workers qualify for gratuity after one full year of continuous service. The calculation is based on basic salary only. JAFZA firms must also follow the free zone’s labour guidelines when preparing the final settlement. These guidelines cover timelines, record checks, and allowed deductions.

This legal base protects both employees and employers, and keeps JAFZA aligned with national labour standards used across the UAE.

What is JAFZA Gratuity Calculator?

The JAFZA gratuity calculator helps workers and companies in the Jebel Ali Free Zone work out end-of-service benefits with clear numbers. It follows UAE Labour Law rules and the JAFZA free zone framework.

You only enter your basic salary, start date, end date, and the reason for leaving. The tool then applies the correct days of gratuity for your service period.

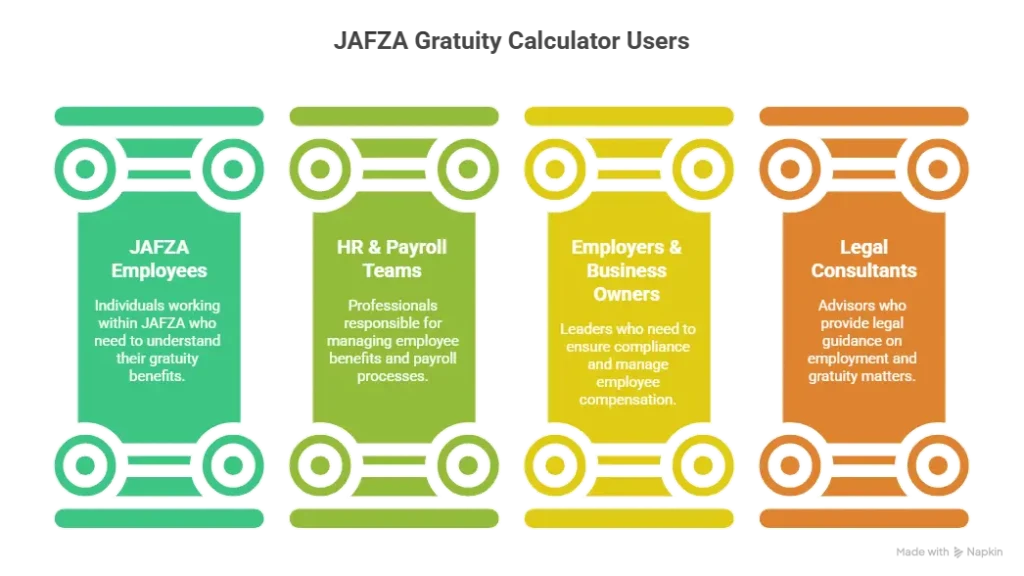

Who Can Use This JAFZA Gratuity Calculator?

1. JAFZA free zone employees

Workers can check their end-of-service rights before resigning or completing their contract. It helps them plan their final settlement and confirm if HR followed the correct formula.

2. HR and payroll teams in JAFZA companies

HR staff can use the calculator to prepare accurate end-of-service sheets. It also reduces errors when applying the 21-day and 30-day rules for long service.

3. Employers and business owners in the Jebel Ali Free Zone

Company owners can use the tool to estimate financial liability before ending contracts or planning workforce changes. It supports better budgeting and compliance with JAFZA rules.

4. Legal consultants checking end-of-service benefits

Lawyers and legal advisers can use the calculator to verify final settlement disputes, salary claims, and unpaid gratuity cases. It helps them confirm if the employer applied the right calculation method.

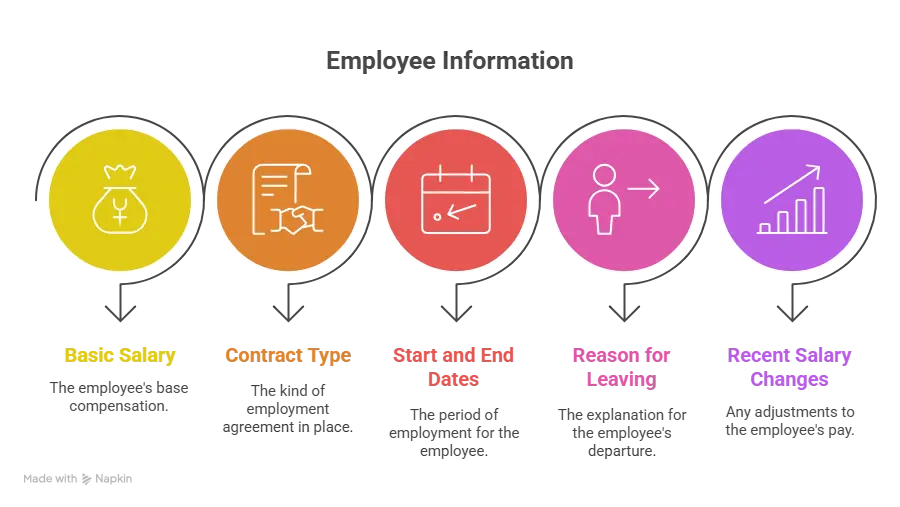

What You Need Before You Calculate

You only need a few details to get your JAFZA gratuity amount. Keep these ready so the calculation stays accurate and matches JAFZA rules.

1. Basic salary in AED

Use the basic salary from your contract or the latest payslip. Allowances are not counted.

2. JAFZA employment contract type

Know if your contract is limited or unlimited. Some companies still use older formats, so check your signed agreement.

3. Start date and last working date

Your total service period depends on these two dates. The calculator uses them to measure full years and partial months.

4. Reason for leaving

Resignation, termination or contract completion can affect the payout. JAFZA follows UAE labour rules for each case.

5. Salary changes in the last year

If your basic salary increases, gratuity is based on the latest basic salary, not the old one. Keep your updated payslip handy.

Does Contract Type Change JAFZA Gratuity?

Yes. Limited and unlimited contracts follow the same formula but differ in exit handling.

JAFZA And UAE Labour Law

JAFZA follows its own free zone policies, but many employment rules still come from the federal labour law. Companies inside the zone must follow both systems. Workers also receive the same core protections that apply across the UAE.

JAFZA free zone regulations

JAFZA issues its own employment procedures. These include contract formats, HR approvals, onboarding rules, access passes, and company compliance checks. Employers inside the zone must register contracts through approved JAFZA systems and keep records ready for inspections.

How Federal Decree Law No. 33 of 2021 still applies?

Even though JAFZA is a free zone, the main labour law still guides salaries, working hours, leave rights, termination rules and gratuity. The law sets the minimum protections for workers. JAFZA companies cannot offer benefits below these levels. End-of-service gratuity is also calculated using federal formulas.

When JAFZA policies add extra rules?

JAFZA may introduce additional steps for companies operating inside the zone. Examples include extra document checks, settlement confirmations, or internal clearances before a worker leaves the company. These procedures sit on top of the federal labour rules. Employers and workers must follow both, especially during final settlement and visa cancellation.

Mainland vs JAFZA Free Zone Gratuity

Common points with UAE Labour Law

JAFZA follows the core rules from Federal Decree Law No. 33 of 2021. This means the basic structure of gratuity stays the same.

Common points include:

- Gratuity is based on basic salary only.

- One full year of service is the minimum requirement.

- The first five years follow the 21-day rule.

- Service beyond five years follows the 30-day rule.

- The final amount cannot cross the cap of two years of basic salary.

- Allowances are not part of the calculation.

- Both resignation and termination use the same formula, unless the case involves misconduct.

These shared rules keep calculations familiar for anyone who has worked in UAE mainland companies.

Where JAFZA practice may be different?

JAFZA companies may follow additional internal procedures. These steps can affect how the final settlement is processed, not how it is calculated.

Possible differences:

- HR may need to complete approvals through Dubai Trade or JAFZA systems.

- Some companies request clearance from security, finance, or asset control before releasing the payment.

- Extra verifications may apply if the salary structure changed in the last months.

- Some firms follow stricter timelines for returning equipment or completing exit formalities.

These differences sit on the process side, not the formula. The calculation still follows federal law unless a contract states stronger employee benefits.

Why employees must confirm with HR?

Each JAFZA company may set internal steps for exit and settlement. To avoid delays, workers should confirm:

- which contract type is on record,

- if HR uses salary changes in the last year,

- the expected settlement timeline,

- what documents must be cleared before payment.

Checking these points early helps prevent confusion during the final month of employment.

JAFZA Gratuity Eligibility Rules

- You must complete at least one full year of continuous service to qualify for gratuity in JAFZA.

- Service is counted from the start date shown on the JAFZA employment contract and recorded in the company system.

- Short unpaid leave does not break continuity.

- Long unpaid leave may reduce the total service period if it is marked as non-paid and non-working in HR records.

- MOHRE and JAFZA guidelines treat only active working months as part of service, so any gap must be confirmed with HR before calculation.

Resignation, Termination, Contract Completion

Eligibility on resignation

You can receive gratuity in JAFZA if you complete at least one full year of service. The payment is based on your basic salary and the years you worked. The reason for leaving does not reduce the amount if your record is clean and your notice period is respected.

Eligibility on termination for normal reasons

If the employer ends the job for normal business reasons, the gratuity stays the same. The service years and basic salary decide the final amount. HR must also include any pending salary and approved leave in the final settlement.

Loss of rights in gross misconduct cases

Gratuity can be removed if the employer proves gross misconduct under UAE Labour Law. This applies only when the case meets the legal conditions. HR must document the incident and follow due process before denying payment.

JAFZA Gratuity for Expatriate Workers

Expat employees in JAFZA receive the same end of service rights as other private-sector workers under the federal labour law, unless a JAFZA rule adds more detail. The gratuity is linked to the worker’s basic salary and full years of service inside the free zone.

Rules for non-UAE nationals

Expat workers qualify for gratuity after completing one full year of continuous service. Nationality does not affect the amount. The calculation follows the standard 21-day and 30-day rate once the employee reaches the required service years.

Ties with visa and residence status

The visa must be active under a JAFZA company at the time of ending employment. The company handles visa cancellation only after all dues are cleared. Gratuity is still payable even if the worker plans to leave the UAE after cancellation.

Impact of job change within the free zone

If the worker moves from one JAFZA company to another with proper approval, the new job counts as a fresh employment contract. Previous service does not transfer unless both companies agree in writing and record it in HR files. The employee should keep copies of contracts, WPS slips, and any settlement record to avoid disputes later.

JAFZA Limited Contract Gratuity Rules

Service calculation from start to end date

JAFZA counts service from the contract start date to the last working day. HR uses the dates recorded in the JAFZA system. Any unpaid leave longer than the approved limit may reduce the total service period.

Gratuity when the contract ends normally

If the worker completes the full limited term, gratuity is paid on the full service years. The formula follows the UAE Labour Law, using basic salary only. The worker receives the standard 21 days per year for the first five years, then 30 days per year after that.

Gratuity when the contract is ended early

If either side ends the contract before its expiry, gratuity is still paid on completed service. Early exit penalties depend on the contract terms, but the core gratuity remains protected unless the case falls under gross misconduct.

JAFZA Gratuity Rules For Different Contract Types

JAFZA Limited Contract Gratuity Rules

- The service period runs from the joining date to the final working day.

- HR uses this full period when they check your end of service benefits.

- If the limited contract finishes on the agreed date, the worker receives the normal gratuity based on years of service and basic pay.

- The calculation follows the UAE formula used inside the free zone.

- If the limited contract ends early for a valid reason, gratuity is still paid when the worker has completed at least one year.

- If the contract ends early due to a serious breach proven by the employer, gratuity may not apply.

- JAFZA HR can review the case if there is a dispute.

JAFZA Unlimited Contract Gratuity Rules

- JAFZA follows the same core gratuity rules set in Federal Decree Law No 33 of 2021.

- The calculation still uses basic salary and full years of service.

- For unlimited contracts, service runs from the joining date to the last working day.

- HR records, WPS slips, and contract addendums help confirm the exact period.

- Resignation and termination are both eligible for gratuity, as long as the employee completes one full year.

- The amount does not drop for resignation, because JAFZA uses the updated UAE model where the rate stays the same.

- If the employer ends the job for normal reasons, gratuity is paid in full.

- If termination is for proven gross misconduct under Article 44 of the law, payment can stop.

- Employees should confirm any special internal rules with JAFZA HR because some companies apply extra checks before releasing the final amount.

End Of Service Limited Vs Unlimited Comparison In JAFZA

Below is a clear comparison between limited and unlimited contract. You can see how both contract types work for gratuity inside JAFZA.

Point | Limited Contract | Unlimited Contract |

|---|---|---|

Service period count | From start date to contract expiry or early end | From start date to last working day |

When gratuity is paid | When the contract ends, or when it ends early for a valid reason | When employment ends for any normal reason |

If the employee resigns | Gratuity is paid if service is at least one year | Gratuity is paid if service meets the one year rule |

If terminated | Full rights unless it is a gross misconduct case | Full rights unless it is a gross misconduct case |

Notice period | As written in the contract | As per company policy or contract terms |

Early exit impact | May affect settlement if notice rules are not followed | Notice rules apply but do not reduce gratuity unless misconduct applies |

Formula applied | Same UAE Labour Law formula | Same UAE Labour Law formula |

Key Notes

Special Work Models in JAFZA

1. Part time and temporary contracts

Part time and temporary staff can also receive gratuity if they complete one full year of service. The amount is based on the actual working hours recorded in the contract. HR teams often use a prorated method, so the payout reflects the real workload. Always confirm that your hours are updated in the payroll system.

2. Project based work

Some JAFZA companies hire workers for a project with a fixed end date. Gratuity applies when the worker completes at least one year, even if the project ends earlier. If the project finishes before the first year, gratuity does not apply. Basic salary stated in the contract is used for the calculation.

When to confirm with JAFZA HR for special cases?

Special job models sometimes follow extra rules. Confirm details with JAFZA HR when:

- your contract has mixed work hours,

- you worked on more than one project under the same employer,

- your role shifted from part time to full time,

- you were transferred within group companies inside the free zone.

Clear HR records help avoid issues during final settlement.

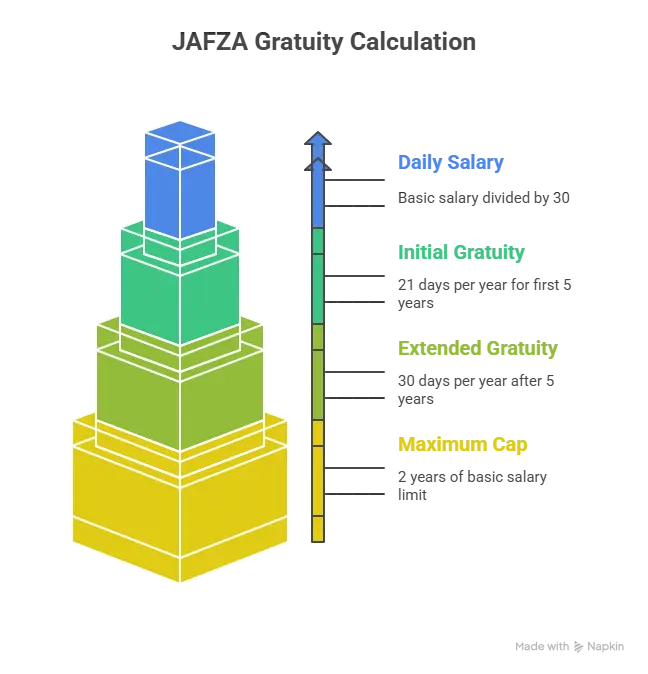

JAFZA Gratuity Formula, How Calculation Works?

The gratuity amount in JAFZA follows the same base method used in UAE Labour Law. Only the basic salary is counted, not allowances.

- Daily Basic Salary

- Basic salary ÷ 30

This figure is used in all steps.

Years Of Service Used In Formula

Service years come from the start date to the last working day. Partial years also count and are calculated as a fraction.

For The First Five Years

- 21 days of basic salary for each completed year.

After Five Years

- 30 days of basic salary for each completed year.

Maximum Allowed Amount

- The final gratuity cannot be more than two years of basic salary, even if the formula gives a higher number.

When The Formula Does Not Apply?

- No gratuity is paid if the employee is dismissed for proven gross misconduct under UAE Labour Law.

- Service below one full year also does not qualify.

Basic Salary And Daily Wage

- Basic salary is the base figure for all JAFZA gratuity calculations.

- Allowances such as housing, transport, phone or overtime do not count.

- Daily wage is taken by dividing the monthly basic salary by 30.

- This daily rate is then used to calculate the number of gratuity days earned for each year of service.

These values form the starting point for every JAFZA end of service calculation.

Standard Gratuity Formula in JAFZA

- 21 days of basic salary per year for the first 5 years

- 30 days of basic salary per year after 5 years

- Maximum cap, two years of basic salary

JAFZA follows the gratuity pattern set under the federal labour framework. The free zone uses basic salary only, not the full monthly package. This keeps the calculation clear for both staff and HR teams.

How the formula works:

- For each completed year in the first five years, the worker earns a gratuity equal to 21 days of basic wage.

- From the sixth year onward, the worker earns 30 days of basic wage per year.

- The total payout cannot go above two years of basic salary, even if the service is long. This cap applies across all free zone companies.

These numbers help employees check if their final amount matches the legal formula. HR teams also rely on the same structure when preparing the final settlement.

Year Wise Breakdown

Workers in JAFZA earn gratuity based on their completed service. The rules follow clear service brackets.

Service less than 1 year

- No gratuity is paid. The law requires at least one full year of work.

Service between 1 and 5 years

- Each completed year earns 21 days of basic salary. The calculation uses daily wage, which comes from basic salary divided by 30.

Service above 5 years

- The first five years stay at 21 days per year, while all years after that use 30 days per year. This higher rate rewards long service.

- The final figure cannot go beyond the limit of two years of basic salary.

Partial Years And Months In JAFZA

Gratuity in JAFZA includes full years and partial service. The full period from your start date to your last working day is counted.

Pro rata calculation for the last year

If the last year is not complete, the days are calculated on a pro rata basis. The daily wage is used to find the exact value.

How the calculator handles months and days?

The calculator reads the exact dates, then converts the remaining months and days into a payable amount. This avoids guesswork and keeps the result aligned with UAE Labour Law.

Simple Examples

Example 1: half year If you worked 3 years and 6 months, the system applies: 3 full years at the correct rate plus 6 months calculated as 0.5 of the yearly rate.

Example 2: only a few months If you completed 2 years and 3 months, the 3 months are added as 0.25 of one year based on the daily wage.

Both examples show how even small service periods are added to the final gratuity amount, as long as the employee has passed one full year of service in JAFZA.

JAFZA Gratuity Excel And Manual Formula

You can calculate JAFZA gratuity in a simple sheet. You only need the basic salary, service period and the correct days per year.

Manual formula for spreadsheets

- Daily wage = Basic salary ÷ 30

- For service up to 5 years, gratuity = Daily wage × 21 × number of years

- For service above 5 years, gratuity =

- (Daily wage × 21 × 5)

- plus (Daily wage × 30 × years after 5)

Fields to include in your Excel file

- Basic salary

- Start date

- Last working date

- Years of service

- Days used in calculation

- Final gratuity amount

Template guide

You can prepare a small sheet with these fields and apply the formulas. This helps HR teams and staff check their numbers before the final settlement.

JAFZA Gratuity Example Calculations

Example 1: Short Service Employee in JAFZA

Scenario

- Basic salary: AED 6,000

- Service in JAFZA: 3 years

- Reason for leaving: normal resignation or contract end

- No gross misconduct, so gratuity is due

Step 1: Find the daily basic wage

- Gratuity in JAFZA uses basic salary only.

- Monthly basic salary: AED 6,000

- Daily wage = 6,000 ÷ 30

- Daily wage = AED 200

Step 2: Work out eligible gratuity days

- For the first five years, JAFZA follows the 21 days rule.

- Service years: 3

- Gratuity days per year: 21

- Total gratuity days = 3 × 21

- Total gratuity days = 63 days

Step 3: Calculate the gratuity amount

Now link the daily wage with the total gratuity days.

- Daily wage: AED 200

- Gratuity days: 63

- Gratuity amount = 200 × 63

- Gratuity amount = AED 12,600

This example fits a simple case, short service in JAFZA with a clean record and no complex deductions.

Example 2: Long Service Employee

A long service case helps you see where the 30 day rate starts and how the cap works.

Basic salary example

- AED 10,000 per month.

Service period

- 8 years in a JAFZA company.

Step 1: find the daily wage

- 10,000 ÷ 30 = AED 333.33 per day.

Step 2: apply the 21 day rate for the first 5 years

- 21 days × 333.33 = AED 6,999 per year.

- 6,999 × 5 years = AED 34,995.

Step 3: apply the 30 day rate for the next 3 years

- 30 days × 333.33 = AED 9,999 per year.

- 9,999 × 3 years = AED 29,997.

Step 4: add both parts

- 34,995 + 29,997 = AED 64,992 total gratuity.

Step 5: check the legal cap

- Gratuity cannot cross two years of basic salary.

- Two years basic salary = 10,000 × 24 = AED 240,000.

- The calculated amount is below the cap, so it stands as is.

Final gratuity for this example = AED 64,992.

Example 3: Resignation in JAFZA

An employee who resigns after five full years still receives gratuity. The calculation stays linked to basic salary and years of service.

Example scenario

- Basic salary: AED 7,000

- Service length: 5 years and 2 months

- Leaving reason: resignation

How the formula applies?

- First 5 years, use 21 days per year

- Extra months are counted on a pro rata basis

- No reduction for resigning after five years

Breakup

- 21 days × 5 years = 105 days

- Daily wage = 7,000 ÷ 30 = AED 233.33

- Gratuity for 5 years = 105 × 233.33 = AED 24,499

- Extra 2 months, pro rata = AED 816

Total gratuity = AED 25,315 approximately, subject to company records and JAFZA checks.

Example 4: Termination With Notice

A normal termination in JAFZA still gives the employee full gratuity rights as long as the reason is not gross misconduct. The formula stays the same, based on service years and basic salary.

Normal termination by employer

The employer issues written notice. The notice period is paid in full. Service end date must match the final day of employment listed in the letter.

How the gratuity is calculated

The calculator uses:

- basic salary

- total service years and months

- 21 days per year for up to five years

- 30 days per year after five years

- pro rata for partial years

- cap of two years’ basic salary

No reduction applies because the employee did not resign.

Sample final settlement summary

Below is a simple example to show what HR usually includes.

- unpaid salary for last month

- gratuity amount

- payment for unused leave days

- notice period pay

- allowed deductions, if any loan is pending

This gives the employee a clear picture of the full settlement that JAFZA companies prepare at the end of service.

Factors That Change Your JAFZA Gratuity Amount

Gratuity in JAFZA can rise or drop based on several points. Each point affects the service length or the basic salary used in the formula. Workers and HR teams should check these before running any calculation.

Changes In Basic Salary

A change in basic salary can shift the final gratuity figure. HR must use the last basic salary stated in the contract or payroll record.

Salary increase in the last year

If your basic salary was raised, the updated amount becomes the base for the whole calculation. It does not matter when the increase was given. The last active basic salary is used.

Which salary figure HR should use

HR should check the latest contract amendment, WPS slips, or approved HR letter. Allowances do not count.

Effect of demotions or written changes

If the basic salary was reduced through a formal written agreement, the lower amount applies. If no written approval exists, the old salary can be used during a dispute.

Unpaid Leave And Suspensions

- Unpaid leave reduces your service period.

- Those days are removed from the gratuity calculation.

Only paid service time counts toward end-of-service benefits.

If an employee takes two months of unpaid leave, those two months are deducted from total service.

- This directly reduces the final gratuity amount.

- Suspension without pay works the same way.

- The suspended days do not count as active service.

If suspension later becomes a warning only, HR may restore those days. This depends on written company records.

Always check:

- Leave approval letters

- Payroll records

- Suspension notices

These documents decide how many days count in your final service years.

Deductions From Gratuity

Not every employee receives the full calculated amount. Certain legal deductions may apply at final settlement.

Loan repayments

- If you took a company loan, the unpaid balance can be deducted from gratuity.

- HR must show written proof of the outstanding amount.

Confirmed damages

- If the employee caused real financial damage to company property, recovery is allowed.

- The amount must be supported by evidence and internal findings.

Company property not returned

- Unreturned laptops, tools, access cards, or vehicles may reduce the final payout.

- The value must match actual replacement cost.

Important rule

- Random deductions are not allowed.

- Every deduction needs written records and employee notification.

If deductions seem unfair, the employee can raise a complaint through MOHRE or legal channels.

Gratuity Limit And Caps

In JAFZA, gratuity has a maximum legal cap. This limit protects companies from unlimited payout risk. The cap is equal to two years of basic salary only. Even if service is very long, payment cannot go above this limit.

How the calculator checks the cap?

- The calculator first finds the full gratuity amount.

- Then it compares it with the two-year salary value.

- If the result is higher, it auto-applies the legal cap.

Simple example

- Basic salary: AED 10,000

- Two-year cap: AED 240,000

- If your full gratuity equals AED 260,000,

- You will legally receive AED 240,000 only.

This rule comes from UAE Labour Law Article 51. It also applies inside JAFZA free zone contracts.

Can Gratuity Exceed Two Years of Salary in JAFZA?

No. The legal cap is strictly two years of basic salary.

JAFZA Gratuity On Resignation And Termination

Gratuity in JAFZA depends on how and why employment ends. Resignation and termination do not give the same result in every case. Contract type and notice also matter.

JAFZA Resignation Gratuity Rules

- Rights if employee resigns after one year

- An employee becomes eligible after one full year of continuous service.

- Before one year, no gratuity is paid.

After one year:

- Gratuity is calculated on basic salary only

- Service years are counted from start date to last working day

- The standard UAE gratuity formula applies in most JAFZA cases

Effect of short notice or no notice

If proper notice is not served, the employer may deduct:

- Salary for missing notice days

- Any contract-based penalties

Gratuity itself is not cancelled due to short notice. Only deductions are adjusted in the final settlement.

Gratuity when employee leaves for another job

If an employee resigns to join another company:

- Gratuity still applies

- Previous employer must settle dues

- New work permit does not cancel old gratuity rights

Visa transfer inside JAFZA or to mainland does not block payment.

Do I Get Gratuity If My JAFZA Contract Ends Normally?

Yes. Full gratuity applies when a fixed contract ends properly.

JAFZA Free Zone Vs Mainland UAE Gratuity

Many employees think gratuity works the same everywhere in Dubai. That is not always true. JAFZA follows UAE Labour Law. But it also applies its own free zone procedures. Understanding this difference avoids payment delays and disputes.

Common Points With UAE Labour Law

These rules apply in both JAFZA and mainland UAE:

- Gratuity is based on basic salary only

- First 5 years = 21 days per year

- After 5 years = 30 days per year

- Maximum cap = two years of basic salary

- Minimum service = one year

- Paid on resignation, termination, or contract completion

- Gross misconduct can erase gratuity rights

The legal base comes from Federal Decree Law No. 33 of 2021.

Where JAFZA Practice May Be Different

These areas often differ in real life handling:

- Final settlement approval goes through JAFZA HR systems

- Clearance depends on company portal and JAFZA access cards

- Delays may occur due to zone clearance and visa coordination

- Some employers apply internal JAFZA policies before payment release

The formula stays legal. The process changes, not the right.

Why Employees Must Confirm With HR

Before leaving a JAFZA company, always confirm:

- Your last working day

- Your basic salary in MOHRE records

- Your contract type

- Any active loans or assets

- Your final visa status

This avoids short payments and disputes.

When To Rely On JAFZA HR Guidance?

Some cases need direct confirmation from JAFZA HR. This helps avoid wrong calculations and future disputes.

Always ask HR when:

- Your contract has special clauses

- Your job role changed during service

- Your salary structure changed many times

- Your termination reason is unclear

- Your company follows extra internal rules

Get written confirmation by email. Keep it as a personal record.

If HR guidance conflicts with UAE Labour Law, you can verify through:

- JAFZA Legal Affairs

- MOHRE complaint system

- A labour legal consultant

This step protects your gratuity rights and final settlement.

Feature | JAFZA Free Zone | Mainland UAE |

|---|---|---|

Salary Used | Basic Only | Basic Only |

Formula | Same | Same |

Process | JAFZA Internal | MOHRE |

Clearance | Mandatory | Not Mandatory |

Is JAFZA Gratuity Different From Mainland UAE?

The formula is the same. Only internal process and approvals differ.

WPS And Payment Proof

In JAFZA, gratuity payments must follow proper banking channels. Most companies use the Wage Protection System for salary records.

Gratuity is usually paid through:

- UAE bank transfer

- Approved exchange house

- Company payroll account

This creates a legal payment trail.

Employees should always keep:

- Bank statements

- Final payslips

- WPS transaction proof

These records help if any dispute starts later.

If payment is delayed or missing, these documents act as your strongest evidence.

Employee Checklist Before Leaving A JAFZA Company

Before your last working day, make sure nothing is missed. This list helps protect your money and your record.

Use this checklist as your safety net.

Documents To Collect

- Employment contract

- Keep your signed JAFZA contract copy.

- It proves your start date, job title, and basic salary.

Salary slips and WPS reports

- Download recent salary slips.

- Ask HR for WPS payment history if needed.

- This confirms your basic wage for gratuity.

Leave records and approvals

- Collect your annual leave balance.

- Save emails or HR approvals for leave and unpaid days.

- These affect your final settlement.

What Documents Are Required for JAFZA Gratuity Claim?

You need employment contract, salary slips, WPS records, and last working day proof.

Final Summary

JAFZA gratuity is a legal right for employees who complete at least one full year of service. The calculation is based on basic salary only, using 21 days per year for the first five years and 30 days per year after that, with a maximum cap of two years of basic salary. While the formula follows UAE Labour Law, the process inside JAFZA depends on internal free zone procedures. Always confirm your service records, salary base, and settlement timeline with HR before your last working day to avoid delays or disputes.